Tags

Financial Systemic Issues: Booms and Busts - Central Banking and Money - Corporate Governance - Cryptocurrencies - Government and Bureaucracy - Inflation - Long-term Economics - Risk and Uncertainty - Retirement Finance

Financial Markets: Banking - Banking Politics - Housing Finance - Municipal Finance - Sovereign Debt - Student Loans

Categories

Blogs - Books - Op-eds - Letters to the editor - Policy papers and research - Testimony to Congress - Podcasts - Event videos - Media quotes - Poetry

Why can’t the US reform its housing-finance sector?

Published by the R Street Institute.

The attached policy brief appeared in the Summer 2016 edition of Housing Finance International, the quarterly journal of the International Union for Housing Finance (IUHF).

It is sobering to Americans that the U.S. housing finance collapsed twice in three decades: in the 1980s and again in the 2000s. This is certainly an embarrassing record.

The giant American housing finance sector, with $10 trillion in mortgage loans, is as important politically as it is financially. Many interest groups want to receive government subsidies through the housing finance system. This makes it very hard to reform.

From the 1980s to today, U.S. housing finance has been unique in the world for its overreliance on the so-called “government-sponsored enterprises,” Fannie Mae and Freddie Mac. Fannie and Freddie get government guarantees for free, which are said to be only “implicit,” but are utterly real. According to Fannie and Freddie in their former days of power and glory, this made American housing finance “the envy of the world.” In fact, the rest of the world did not feel such envy. But Fannie and Freddie did attract investment from the rest of the world, which correctly saw their issues as U.S. government credit with a higher yield. In the 2000s, this channeled the savings of thrifty Chinese and others into helping inflate American house prices into their amazing bubble. Fannie and Freddie became a key point of concentrated systemic vulnerability.

In 2008, Fannie and Freddie went broke. What schadenfreude my German housing finance colleagues enjoyed after years of being lectured on the superiority of the American system! Official bodies in the rest of the world pressured the U.S. Treasury to protect their investments in the obligations of the insolvent Fannie and Freddie, which the Treasury did and continues to do. The Federal Reserve, in the meantime, has become the world’s biggest investor in Fannie and Freddie securities.

Almost eight years after the financial collapse, America is still unique in the world for centering its housing finance sector on Fannie and Freddie, even though they have equity capital that rounds to zero. They are primarily government-owned and entirely government-controlled housing finance operations, completely dependent on the taxpayers. Nobody likes this situation, but it has outlasted numerous reform efforts.

Is there a way out of this statist scheme—can we move American housing finance toward something more like a market? Is there a way to reduce the distortions caused by Fannie and Freddie, to control the hyper-leverage that inflates house prices and the excessive credit that sets up both borrowers and lenders for failure? Can we reduce the chance of repeating the mistakes of 1980 to 2007? Here are some ideas.

Restructure Fannie and Freddie

The original government bailout of Fannie and Freddie created senior preferred stock with a 10 percent dividend, which the U.S. Treasury bought on behalf of the taxpayers. This was later amended to make the dividend be all their net profit. That meant there would never be any reduction of the principal, and the GSEs will be permanent wards of the state.

It is easy, however, to calculate the cash-on-cash internal rate of return (IRR) to the Treasury on its $189.5 billion investment in senior preferred stock, given the dividend payments so far of $245 billion. This represents a return of about 7 percent – positive, but short of the required 10 percent. As Fannie and Freddie keep sending cash to the Treasury, the IRR will rise, and will reach a point when total cash paid is equivalent to a 10 percent compound return, plus repayment of the entire principal. That is what I call the “10 Percent Moment.” It provides a uniquely logical point for reform, and it is not far off, perhaps in early 2018.

At the 10 Percent Moment, whenever it arrives, Congress should declare the senior preferred stock fully repaid and retired, as in financial substance, it will have been. Simultaneously, Congress should formally designate Fannie and Freddie as systemically important financial institutions (SIFIs). They are unquestionably SIFIs – indeed, they are Global SIFIs – able to put not only the entire financial system, but also the finances of the U.S. government at risk. This is beyond the slightest doubt.

As soon as Fannie and Freddie are designated officially – as well as in economic fact – as SIFIs, they will get the same minimum equity capital requirement as bank SIFIs: 5 percent of total assets. At their current size, this would require about $250 billion in equity. They must, of course, be regulated as undercapitalized until they aren’t. Among other things, this means no dividends on any class of stock until the capital requirement is met.

As SIFIs, Fannie and Freddie will and should get the Federal Reserve as their systemic risk regulator, in addition to their housing finance regulator.

It is impossible to take away Fannie and Freddie’s too-big-to-fail status, no matter what any government official says or does. Therefore they should pay the government for its ongoing credit guaranty, on the same basis as banks have to pay for deposit insurance. I recommend a fee of 0.15 percent of total liabilities per year.

Then Fannie and Freddie will be able to compete in mortgage finance on a level basis with other SIFIs, and swim or sink according to their competence.

Promote skin in the game for mortgage originators

A universally recognized lesson from the American housing bubble was the need for more “skin in the game” of credit risk by those involved in mortgage securitization. Lost in the discussion is the optimal point at which to apply credit risk skin in the game. This optimal point is originator of mortgage loans, which should have a junior credit risk position for the life of the loan. The entity making the original mortgage is in the best position to know the most about the borrower and the credit risk of the borrower. It is the most important point at which to align incentives for creating sound credits.

The Mortgage Partnership Finance (MPF) program of the Federal Home Loan Banks was and is based on this principle (I had the pleasure of leading the creation of this program). It finances interest-rate risk in the bond market but keeps the junior credit risk with the original lender. The result was excellent credit performance of the MPF mortgage loans, including through the 2000s crisis.

I believe this credit-risk principle is obvious to most of the world. Why not to the United States?

Create countercyclical LTVs

As the famous investor Benjamin Graham pointed out long ago, price and value are not the same: “Price is what you pay, and value is what you get.” Likewise, in mortgage finance, the price of the house being financed is not the same as its value: in bubbles, prices greatly exceed the sustainable value of houses. Whenever house prices are in a boom, the ratio of the loan to the sound lendable value becomes something much bigger than the ratio of the loan to the inflated current price.

As the price of any asset (including houses) goes rapidly higher and further over its trend line, the riskiness of the future price behavior becomes greater—the probability that the price will fall continues to increase. Just when lenders and borrowers feel most confident because of high collateral “values” (which really are prices), their danger is in fact growing. Just when they are most tempted to lend and borrow more against the price of the asset, they should be lending and borrowing less.

A countercyclical LTV (loan-to-value ratio) regime reduces the maximum loan size relative to current prices, in order to keep the maximum ratio of loan size to underlying lendable value more stable. The boom would thus induce smaller LTVs, and greater down payments, in bubbly markets—thus providing a financial stabilizer and an automatic dampening of price inflation.

Countercyclical capital requirements for financial institutions reduce the leverage of those lending against riskier prices. The same logic applies to reducing the leverage of those who are borrowing against risky prices. We should do both.

Canada provides an interesting example of where countercyclical LTVs have actually been used; Germany uses sustainable lendable value as the same basic idea. The United States needs to import this approach.

Liquidate the Fed’s mortgage portfolio

What is the Federal Reserve doing holding $1.7 trillion of mortgage-backed securities (MBS)? The authors of the Federal Reserve Act and generations of Fed chairmen since would have found that impossible even to imagine. This massive MBS portfolio means the Fed allocates credit to housing through its own balance sheet. Its goal was to push up house prices, as part of its general scheme to create “wealth effects.” It succeeded— house prices have not only risen rapidly, but are back over their trend line on a national average basis. This means, by definition, that the Fed also has made houses less affordable for new buyers.

Why in 2016 is the Fed still holding all these mortgages? For one thing, it doesn’t want to recognize losses when selling its vastly outsized position would drive the market against it. Some economists argue that losses of many times your capital do not matter if you are a fiat currency central bank. Perhaps or perhaps not, but they would be embarrassing and cut off the profits the Fed sends the Treasury to reduce the deficit.

Whatever justification there might have been in the wake of the collapsed housing bubble, the Fed should now get out of the business of manipulating the mortgage-securities market. If it is unwilling to sell, it can simply let its mortgage portfolio run off to zero over time through maturities and prepayments. It should do so, and cease acting as the world’s biggest savings and loan.

The collapses of the 1980s and 2000s should have taught the American government a lesson about the effects of subsidized, overleveraged mortgage markets. It didn’t. The reform of the Fannie and Freddie-centric U.S. housing finance sector has not arrived, nor is there any sign of its approach. But we need to keep working on it.

The Senate needs to pass the House’s Puerto Rico bill

Published by the R Street Institute.

The government of Puerto Rico is broke. It now has multiple defaults on its record, most recently for $367 million in May. More and bigger defaults are on the way, probably beginning July 1. It’s already June 22.

The U.S. Senate should pass the U.S. House’s Puerto Rico bill now.

The House approved the bill by a wide margin, after a long and thorough bipartisan discussions that included sensible compromises and ultimate agreement between the administration and the legislators. The bill gets all the essential points right. These are:

The creation of an emergency financial control board, or “Oversight Board,” to get under control and straighten out the financial management and fiscal balance of the Puerto Rican government.

An orderly and equitable process overseen by the board to address restructuring the government’s unpayable debts.

Beginning a long-term project to move Puerto Rico toward a successful market economy and away from its failed government-centric one.

Of course, any complex set of legislative provisions can give rise to arguments and possibly endless debates about details. That would be a big mistake.

It’s time to enact the bill and get the essentials in place as soon as possible.

R Street and Americans for Tax Reform urge the Senate to pass H.R. 5278 (PROMESA)

Published by the R Street Institute.

June 21, 2016

Dear Senator,

On behalf of the undersigned free market organizations, we urge you to vote “Yes” on the House-passed H.R. 5278, the Puerto Rico Oversight, Management, and Economic Stability Act of 2016 (PROMESA). Puerto Rico faces many challenges, and unfortunately the territory’s fiscal challenges cannot be fixed overnight. However, by putting strong, independent oversight in place, requiring fiscal reforms, and creating a path for addressing financial debt, PROMESA lays the foundation for prudent fiscal management that will lead to future solvency.

The Puerto Rican crisis is the result of many years of fiscal and economic mismanagement, and both the island’s own government and the federal government are complicit. While untangling the web of failed policy will take time, the fact remains: Puerto Rico is broke. The Puerto Rican government is already failing to meet its debt obligations, and with every day that passes, the probability of a crisis increases.

With defaults, combined unfunded pension and debt obligations over $115 billion, and the Puerto Rican government’s failure to produce audited financial statements for several fiscal years, it is imperative to establish financial oversight, get an accurate understanding of the situation, and create an appropriately calibrated fiscal plan to restore growth. The Oversight Board set out in PROMESA is empowered to do exactly this. The Oversight Board will exercise its authority to acquire accurate financial information, establish fiscal plans, create budgets, negotiate with creditors, and ensure enforcement of the deals and plans created under its authority.

While this oversight control is the required first step toward abating Puerto Rico’s crisis, PROMESA also enacts several immediate pro-growth reforms, including altering the island’s unemployment generating minimum wage requirements and overtime regulations, and putting a plan in place for infrastructure improvements. These changes are an important part of altering the island’s path, and we urge the congressional task force created by the bill to search for further opportunities to reform policies currently limiting Puerto Rico’s growth and promote a market economy.

PROMESA lays out a process to ensure the island’s creditors are treated justly during any future debt restructuring. It encourages voluntary restructuring, requires the Oversight Board to ‘respect the relative lawful priorities’ of the various debt classes, and distinguishes between debt obligations and pensions.

We applaud the House for its leadership on this issue. The bill has been strengthened, and currently represents Puerto Rico’s best chance to return solid fiscal footing. It is now the Senate’s turn. By voting for passage, Senators will fulfill their obligation under the Constitution to ‘make all the needful rules’ regarding the territories. We urge you therefore to vote yes.

Sincerely,

R Street Institute

Americans for Tax Reform

The PBGC: A broke insurance company sponsored by your government

Published in Real Clear Markets.

Imagine an insurance company with assets of $88 billion, but liabilities of $164 billion. It has a huge deficit: a net worth of a negative $76 billion, and a capital-to-asset ratio of minus 87 percent.

Would any insurance commissioner anywhere allow it to remain open and to keep taking premiums from the public to “insure” losses it manifestly cannot pay? Of course not. Would any rational customer buy an insurance policy from it, when the company cannot even hope to honor its commitments? Nope.

But there is such an insurance company, open and in business and taking in new premiums for obligations it will not be able to pay. Needless to say, it is a government insurance company, since no private entity could continue in business in such pathetic financial shape. It is the Pension Benefit Guaranty Corp. (PBGC), a corporation wholly owned by the U.S. government, operating on an obviously failed model. Its board of directors comprises the secretaries of the departments of Labor, Commerce and the Treasury; quite a distinguished board for such egregious results.

There are two financially separate parts of the PBGC: the Single-Employer Program, which insures the defined-benefit pension plans of individual companies; and the Multiemployer Program, which insures union-sponsored plans with multiple companies making pension contributions. The Single-Employer Program has a large deficit, with assets of $86 billion, liabilities of $110 billion and a negative net worth of $24 billion. That is bad enough.

But now imagine an insurance company with assets of $2 billion and liabilities of $54 billion. That is a truly remarkable relationship. Its net worth is negative $52 billion, or 26 times its assets. That is the PBGC’s Multiemployer Program – which, as no one can doubt, is well on the way to hitting the wall.

The PBGC can continue to exist for only two reasons: because the government forces pension plans to buy insurance from it and because its political supporters entertain the abiding hope that Congress will somehow or another give it a lot of other people’s money to cover its unpayable obligations.

Congress should not do this, and so far, it has shown no inclination to announce a taxpayer bailout. But the real simultaneous financial and political crunch will occur when the disastrous Multiemployer Program runs out of cash while still being oversupplied with obligations. This moment is readily foreseeable, but has not yet arrived and is estimated to be a number of years off.

The PBGC was created by the Employment Retirement Income Security Act of 1974 (ERISA). This put into statue an idea created by the research department of the United Auto Workers union in 1961: let’s get the government to guarantee our pensions. The idea was politically brilliant but, financially, less brilliant.

According to the law, the PBGC was not supposed to be able to get itself into the insolvent status in which it not finds itself. As each PBGC Annual Report always informs us, “ERISA requires that PBGC programs be self-financing.” But they aren’t—not by a long shot, where the value of that long shot is at least $76 billion. What does the “requirement by law” to be self-financing mean when you aren’t and have no hopes to be so?

One thing originally intended to be quite clear we find in the next Annual Report sentence: “ERISA provides that the U.S. Government is not liable for any obligation or liability incurred by PBGC.” To repeat: Not liable. But of course, they said the same thing in statute about Fannie Mae and Freddie Mac. They made Fannie and Freddie put that in bold face type on every memorandum offering their debt for sale. But they bailed out Fannie and Freddie anyway.

As it has turned out, the Fannie and Freddie bailout has proved to provide a positive investment return to the taxpayers: an internal rate of return of about 7 percent so far. But any bailout money put into the PBGC will be simply gone. It would not be an investment, but purely a transfer payment.

That reflects the fact that Fannie and Freddie, when their operations were not perverted by politically mandated excess risk, had a fundamental model capable of making profits, as they did before the housing bubble and now are again. This profit potential is not shared by the PBGC. Its fundamental model is to take politically mandated excess risk in order to promote unaffordable pensions, not to insure them according to rational actuarial principles.

Defined-benefit pension plans have proved beyond doubt to be an extremely risky financial construction. The idea that the government is guaranteeing them encouraged the negotiation of pensions unaffordable to the sponsors in the first place, and the underfunding of pension obligations later. These are the kinds of very costly moral hazards entailed in the very existence of the PBGC. Of course, the PBGC might have, had Congress allowed it to, charged vastly higher premiums. But this would be against the other of its assigned missions: to encourage and promote defined-benefit pensions.

You can understand how this was felt to be a nice idea, but it creates an irresolvable conflict for the PBGC. The corporation is simultaneously supposed to promote the use and survival of defined-benefit pension programs, while it is also supposed to run a sound, self-financing insurance company. Obviously, it has utterly failed at being a sound insurer. Arguably, by creating incentives to design unaffordable pensions, it also failed at promoting defined-benefit pension plans, and has rather accelerated their ongoing demise.

There is no easy answer to the PBGC problem as a whole, but Congress took a sensible and meaningful step with the Kline-Miller Multiemployer Pension Reform Act of 2014. We will devote the next essay to examining the implications of this act and the reasonable attempt to use it recently thwarted by the U.S. Treasury Department.

Does the Federal Reserve know what it’s doing?

Published by the R Street Institute.

The attached policy study was published in Cato Journal, Vol. 36, No. 2.

The Federal Reserve is the most financially dangerous institution in the world. It represents tremendous systemic risk—more systemic financial and economic risk than anybody else. Fed actions designed to manipulate the world’s dominant fiat currency, based on the debatable theories and guesses of a committee of economists, can create runaway consumer price and asset inflation, force negative real returns on people’s savings, reduce real wages, stoke disastrous financial bubbles that lead to financial collapses, distort markets and resource allocation, and in general create financial instability. The Fed has done or is doing all of these things—ironically enough—in the name of pursuing stability. But whatever its intentions, does the Fed actually know what it is doing? Clearly, it hasn’t in the past, and it is exceptionally dubious in principle that it ever can. Since that is true, how can anybody think the Fed should be an independent power?

How high are real house prices?

Published in Real Clear Markets.

“Home prices are back to near-record highs across the U.S.” declared the Wall Street Journal in a June 1 front-page story. They are, indeed, when measured in nominal terms.

The Case-Shiller National House Price Index for the first quarter of 2016 is as high as it was in September 2005, in the late-phase frenzy of the bubble. That was only nine months before the 2006 bubble-market top, which as we know only too well, was followed by collapse. In addition to reaching its 2005 level, the National House Price Index has gone back to well over its trend line—more than 11 percent over. All this is shown in Graph 1.

So the Federal Reserve has gotten its wish for re-inflated house prices (although not its wish for robust economic growth).

Are high house prices good or bad? That depends on whether you are selling or buying. If you are the Fed, it depends on how much you believe that creating asset-price inflation leads to “wealth effects” that improve economic growth.

Of course, besides asset-price inflation, the Fed truly believes in regular old inflation. It has often announced its intent to create perpetual increases in consumer prices. Since the bubble top in 2006, the Consumer Price Index has increased by an aggregate of 17 percent.

This means that house prices – measured in real, inflation-adjusted terms – look different from Graph 1. Real house prices are shown in Graph 2, expressed in constant 2000 dollars. They have still gone up a lot in the last few years, but not as much as in nominal terms. They have matched their level from October 2003, rather than September 2005.

In October 2003, house prices were clearly inflating: they were half way, but only half way, up their memorable bubble run from 1999 to 2006. Do we remember how happy so many people were with those high house prices? Do we remember that the Fed Funds Rate had then been reduced to 1 percent? That the Fed was thinking of wealth effects? At the time (in January 2004), the Wall Street Journal published an article entitled, “Housing Prices Continue to Rise.” It reported that “the decline in interest rates has made housing more affordable,” that forecasts were for “the house party to rage on in 2004”—a good forecast— and that “few housing pundits see much risk of a national plunge in house prices”—a terrible forecast.

In 2003, was it time to pay attention? It was. Going forward from here, can we imagine what house prices would be with genuinely normalized interest rates? In mid-2016, can the pundits see much risk of anything going wrong?

Power, independence and guessing

Published in Library Of Law & Liberty.

The Power and Independence of the Federal Reserve is an informative and provocative history of the Fed and its remarkable evolution over a hundred years’ time: a complex institution, in a complex and changing environment.

Very importantly, author Peter Conti-Brown has included the Fed’s intellectual evolution, or the shifting of the ideas that shape its actions as these ideas go in and out of central banking fashion. This account makes readers wonder what new ideas and theories the leaders of the Fed will adopt, reinforce by groupthink with their fellow central bankers, and try out on us in future years.

As for the power wielded by the Fed, it has obviously come a very long way since its beginnings, when it was, as Conti-Brown describes it, “an obscure backwater government agency.” That is hard for today’s Americans to imagine. To illustrate the change, Conti-Brown relates the memorable story of when the new Federal Reserve Board went to President Wilson’s Secretary of the Treasury, William McAdoo, to complain that at a state function the board members were not given sufficient prominence in order of seating. McAdoo took the problem to Wilson. “Well, they might come right after the fire department,” replied the irritated President.

Little could he know that the Fed would become, in time, the global financial fire department, as part of being central bank to a world in which its fiat dollars were the dominant currency.

Of course the Fed has made, and doubtless will continue to make, great mistakes. Its enormous power, combined with its unavoidable human fallibility, renders it without question the most dangerous financial institution in the world—far and away the greatest potential creator of systemic financial risk there is.

Put that together with the other idea in Conti-Brown’s title: independence. He considers many factors affecting the independence the Fed so much wants and so energetically defends. He rightly emphasizes something as crucial as it is little-discussed: the Fed’s budgetary independence. The Fed, as Conti-Brown points out, is entirely free from the “power of the purse” normally exercised by Congress. Instead, it is able to spend whatever it wants out of the very large profits it automatically makes by issuing money, both the printed and the bookkeeping varieties. On the money-issuing and the spending, there is no constraint except its own decisions.

The more independent the Fed is, combined with its power and the huge riskiness of its actions, the bigger an institutional puzzle it represents in a government that was built on the principle of checks and balances.

In the famous conclusion of The General Theory of Employment, Interest, and Money (1936), John Maynard Keynes tells us that “soon or late, it is ideas . . . which are dangerous for good or evil.” This is true in general in human affairs, but it is especially true of the ideas that come, from time to time, to dominate the minds of central bankers—and most importantly, the central bankers who run the Fed. Conti-Brown’s tracing of the ideas of the Fed’s dominant personalities over time is key to understanding the institution.

For example, take the idea of fiat money. This was clearly not what the Fed would be about, in the minds of the authors of the Federal Reserve Act, like then-Chairman of the House Banking Committee, Carter Glass (D-Va.). Conti-Brown writes: “The claim that the new Federal Reserve Notes would represent ‘fiat money’ were fighting words.” He quotes Glass’s defense on the floor of the House of Representatives against the charge: “Fiat money! Why, sir, never since the world began was there such a perversion of terms.” But now the Fed is known by all to be the center and font of the worldwide fiat money system.

Or take inflation. Conti-Brown nicely summarizes the view of William McChesney Martin, Chairman of the Fed for 19 years and under five U.S. Presidents in the 1950s and 1960s: “The keeper of the currency is the one who has to enforce the commitment not to steal money through inflation.” But now the Fed has decided to commit itself to perpetual inflation and has for seven years been stealing money from savers through negative real interest rates—all for the greater good as embodied in its current theories and beliefs.

As Conti-Brown says, it is not the case that there are “objectively correct answers to problems of monetary policy . . . in a democracy.” That is why the Money Question, as impassioned historical debates called it, is always political and not merely technical. Central banking is, he writes, “plagued by uncertainty, model failures, imperfect data, and even central banker ideology.” (He should have left out that “even.”)

Conti-Brown views central bankers as “adjudicating between conflicting views of that uncertainty, those failures, these ideologies.” Quite right, except that he has a more optimistic view of the process than I do. In place of “adjudicating” among uncertainties, a more accurate term would be “guessing.”

This recalls a marvelous letter to the Financial Times of several years ago suggesting that “in mathematics, one answer is right; in literature, all answers are right; and in economics, no answers are right.” Conti-Brown says “it is tempting to throw out the entire enterprise of central banking as politics by another name.” But as he also says, this would not be right, either.

The key fact is that in central banking the uncertainty is high and, therefore, guessing is required. But the cost of mistakes can be enormous. This causes responsible minds to tend to cluster around common ideas and to reinforce each other by saying the same things. The book discusses this clustering in terms of “cognitive capture,” but I think a better description would be “cognitive herding.” This affects central bankers as it does everybody else when confronted with the need to decide and act in the face of ineluctable uncertainty.

In making decisions subject to uncertainty, metaphors are helpful, and Conti-Brown is fond of what he calls “the poetry of central banking”—that is, powerful figures of speech. The most famous such metaphor is that of Chairman Martin, who characterized the Fed as the “chaperone who has ordered the punch bowl removed just when the party was really warming up.” Martin (who studied English and Latin at Yale) “changed the language of central banking,” says Conti-Brown, and therefore its ideas. One can only imagine how surprised Martin would be that, in recent years, the chaperone has been the one pouring bottles of rum into the punch bowl to liven up the party.

Finally, on the subject of the Fed’s independence, Conti-Brown quotes Fed Chairman Ben Bernanke telling his successor, Janet Yellen, that “Congress is our boss.” But does the Fed as an institution really accept that as it insistently defends and pursues its independence? The more the Fed achieves practical independence from Congress, the more intriguingly alien to our fundamental Constitutional order it is.

Time for Congress to vote in the new Puerto Rico bill

Published by the R Street Institute.

A revised bill to address the intertwined debt, fiscal and economic crises of Puerto Rico has just been introduced in the U.S. House. H.R. 5278 proposes “to establish an Oversight Board, to assist the Government of Puerto Rico…in managing its public finances.”

This “assistance” (read, “supervision”) is needed intensely. If all goes well, the House Natural Resources Committee will report the bill out promptly and it will proceed to enactment.

As is well-known, the government of Puerto Rico is broke and defaulting on its debt. At $118 billion, by the committee’s reckoning (which rightly includes unfunded government pensions), that debt is six times the total debt and unfunded pensions of the City of Detroit as it entered bankruptcy. This is a truly big insolvency, which reflects long years of constant fiscal deficits filled in by excess borrowing. Moreover, as the committee points out, Puerto Rico’s “state-run economy is hopelessly inefficient.”

There are three fundamental tasks involved in the complex and massive problems, and the bill addresses all three. These are:

To establish an emergency financial control board to determine the extent of the insolvency, develop fiscal and operational reforms and put the government of Puerto Rico on a sound financial basis. The bill uses the more politic title of “Oversight Board,” but the tasks are the same. They will not be easy and are sure to be contentious, but are necessary.

To restructure the unpayable debt and settle how the inevitable losses to creditors are shared among the parties. The bill gives the Oversight Board the authority, if necessary, to put forth a plan of debt reorganization and the legal framework to reach settlement.

To move Puerto Rico toward economic success – that, is toward a market economy and away from its failed government-centric economy – and thus to give it the potential for future growth. These reforms will not be easy, either, but the bill sets out a process to start the required evolution.

The discussion of the necessary steps has been long and full. Now it’s time for Congress to vote in the new bill.

Puerto Rico: A big default—what next?

Published in the Library Of Law And Liberty.

Rexford Tugwell, sometimes known as “Rex the Red” for his admiration of the 1930s Soviet Union and his fervent belief in central planning, was made governor of Puerto Rico by President Franklin Roosevelt in 1941. Among the results of his theories was the Government Development Bank of Puerto Rico, a bank designed as “an arm of the state,” which is a central element in the complicated inner workings of the Puerto Rican government’s massive insolvency.

The bank has just defaulted on $367 million of bonds – the first, but unless there is congressional action, not the last, massive default by the Puerto Rican government and its agencies on their debt. The Government Development Bank was judged insolvent in an examination last year, but the finding was kept secret. The governor of Puerto Rico has declared a “moratorium” on the bank’s debt, which means a default. A broke New York City in 1975 also defaulted and called it a “moratorium.”

Adding together the Puerto Rican government’s explicit debt of about $71 billion and its unfunded pension liabilities of about $44 billion amounts to $115 billion. This is six times the $18 billion in bonds and pension debt of the City of Detroit, which holds the high honor of being the largest municipal bankruptcy ever.

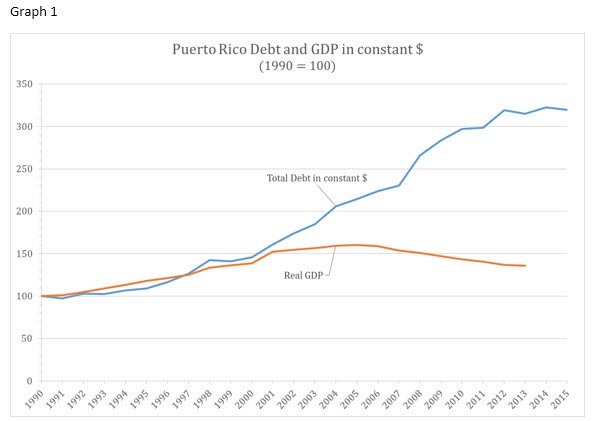

Puerto Rico’s government-centric political economy goes back to Rex the Red, but its budget problems are also long-standing. In this century, the government has run a deficit every year, borrowed to pay current expenses, and then borrowed more to service previous debt until the lenders belatedly ceased lending and the music stopped. Its debt and its real gross domestic product definitively parted company in 2001 and have grown continuously further apart, as shown Graph 1.

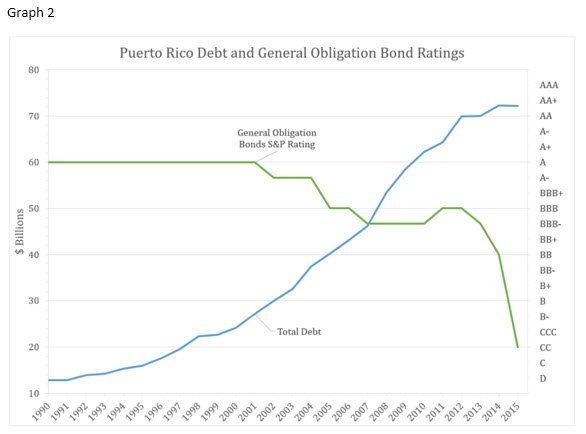

As its debt skyrocketed, the credit ratings of its bonds fell and then crashed. See Graph 2.

Where do we go from here? Addressing the deep, complicated, and contentious problems requires three steps:

The creation of an emergency financial control board to assume oversight and control of the financial operations of the government of Puerto Rico, which has displayed incompetence in fiscal management (or mismanagement), is a central aspect of the solution. This control board can be modeled on those successfully employed to address the insolvencies and financial mismanagement in the District of Columbia in the 1990s, in New York City in the 1970s and in numerous other places. More recently, the City of Detroit got an emergency manager along the same lines.

Such a board would be and must be quite powerful. The sine qua non for financial reform is to establish independent, credible authority over all books and records; to determine the true extent of the insolvency of the many indebted government entities—in particular to get on top of the real condition of the Government Development Bank; and to develop fiscal, accounting, control and structural reforms which will lead to future balanced budgets and control of the level of debt.

Needed reforms cited by Puerto Rican economist Sergio Marxuach in congressional testimony include:

[I]ncrease tax revenues by improving enforcement efforts, closing down ineffective tax loopholes, and modernizing its property tax system; crackdown on government corruption; significantly improve its Byzantine and unduly opaque financial reporting; reform an unnecessarily complicated permitting and licensing system that stifles innovation; … lower energy and other costs of doing business.

That’s a good list of projects.

Does all this take power and responsibility away from the Puerto Rican government? Of course it does – it needs to and it can be done. Under the Constitution, Congress has complete jurisdiction over territories like Puerto Rico. Just as in Washington and New York City, when the problems are straightened out, financial management will revert to the normal local government.

Pollock’s Law of Finance states that “Loans which cannot be repaid, will not be repaid.” Naturally, this law applies to the $115 billion owed by the Puerto Rican government, which is on its way to some form of restructuring and reorganization of debts. It seems clear that this should be done in a controlled, orderly and equitable process, which takes into account the various levels of seniority and standing among the many different classes of creditors.

The pending House bill puts the proposed oversight board in the middle of the analysis and negotiations of competing claims. If the reorganization cannot be voluntarily agreed upon, the process can move to the federal court, where the plan of reorganization would come from the oversight board.

Three objections have been made to this approach. One that has been advertised heavily claims that it is a “bailout.” Since no taxpayer money is planned to go to creditors, this is simply wrong and ridiculous. Bondholders taking losses is the opposite of a bailout.

A second is that bondholders may be disadvantaged versus pension claims, and this may affect the whole municipal bond market. Indeed, in the Detroit bankruptcy, the general obligation bonds got 74 cents on the dollar, while the general city employee pensions got 82 cents— an important haircut, but a smaller one. The political force of pension claims in insolvencies is a credit fact that all investors must take into account. If the national municipal bond market internalizes and prices the risks of unfunded pensions, thereby bringing more discipline on the borrowers, that seems like progress to me.

A third objection is that the bill’s approach would set a precedent for financially struggling states like Illinois, which they might follow. In my judgment, there is zero probability that Illinois or any other state would volunteer to have a financial control board imposed on it. Even leaving aside the fact that Puerto Rico is not a state, this argument is vacuous.

Of fundamental importance is that in the medium term, Puerto Rico must develop a sustainable economy—that is, a market economy to replace its historically government-centric one. Various ideas have been proposed relevant to this essential goal, and much more work is required. This is the most challenging of all the elements of the problem. Steps 1 and 2 must be done first, but Step 3 must be achieved for ongoing success.

One thoughtful investor in municipal bonds, reflecting on Puerto Rico, Illinois and other troubled political entities, concluded, “We don’t trust governments.” That made me think of how there have been more than 180 defaults and restructurings of sovereign debt in the last 100 years and how, further back, a number of American states defaulted on their debts and even repudiated them. So I wrote him, “I think that’s wise.”

Nonetheless, the immediate requirement to deal with the Puerto Rican debt crisis is government action.

Risk doesn’t stand still

Published in Library Of Law And Liberty.

Foolproof: Why Safety Can Be Dangerous and How Danger Makes Us Safe explores the movement and transformation of risks in adapting, self-referencing systems, of which financial systems are a notable example. In this provocative new book, the Wall Street Journal’s chief economics commentator Greg Ip contemplates how actions to reduce and control risk are often discovered to have increased it in some other way, and thus, “how safety can be dangerous.”

This is an eclectic exploration of the theme, ranging over financial markets, forest fires, airline and automobile safety, bacterial adaptation to antibiotics, flood control, monetary policy and financial regulation. In every area, Ip shows the limits of human minds trying to anticipate the long-term consequences of decisions whose effects are entangled in complex systems.

In the early 2000s, the central bankers of the world congratulated themselves on their insight and talent for having achieved, as they thought, the Great Moderation. It turned out they didn’t know what they had really been doing, which was to preside over the Great Leveraging. Consequently, and much to their surprise, they found themselves in the Great Collapse of 2007 to 2009, and then, with no respite, in the European debt crisis of 2010 to 2012.

Ip begins his book two decades before that, in 1989, at a high-level conference on the topic of financial crises. (Personally I have been going to conferences on financial crises for 30 years.) He cites Hyman Minsky, who “for decades had flogged an iconoclastic theory of business cycles that fellow scholars had largely ignored.” Minsky’s theory is often summarized as “Stability creates instability”—that is, periods of safety induce the complacency and the mistakes that lead to the crisis. He was right, of course. Minsky (who was a good friend of mine) added something else essential: the rise of financial instability is endogenous, arising from within the financial system, not from some outside “shock.”

At the same conference, the famous former Federal Reserve Chairman Paul Volcker raised “the disturbing question” of whether governments and central banks “end up reinforcing the behavior patterns that aggravate the risk.” Foolproof shows that the answer is yes, they do.

Besides financial implosions, Ip reflects on a number of natural and engineering disasters, including flooding rivers, hurricane damage, nuclear reactor meltdowns, and forest fires, and concludes that in all of these situations, as well, measures were taken that made people feel safe, “and the feeling of safety allowed danger to re-emerge, often hidden from view.”

The natural and the man-made, the “forests, bacteria and economies” are all “irrepressibly adaptable,” he writes. “Every step we take to suppress the risks . . . will provoke some other, offsetting step.” So “neither the economy nor the natural world turned out to be as amenable to human management” as was believed.

As Velleius Paterculus observed in the history of Rome that he wrote circa 30 AD, “The most common beginning of disaster was a sense of security.”

Why are we like this? Ip demonstrates, for one thing, how quickly memories fade as new and unscarred generations arrive to create their own disasters. Nor is he himself immune to this trait, writing: “The years from 1982 to 2007 were uncommonly tranquil.”

Well, no.

In fact, the years between 1982 and 1992 brought one financial disaster after another. In that time more than 2,800 U.S. financial institutions failed, or on average more than 250 a year. It was a decade that saw a sovereign debt crisis; an oil bubble implosion; a farm credit crisis; the collapse of the savings and loan industry; the insolvency of the government deposit insurer of the savings and loans; and, to top it off, a huge commercial real estate bust. Not exactly “tranquil.” (As I wrote last year, “Don’t Forget the 1980s.”)

“Make the most of memory,” Ip advises. After the Exxon Valdez oil spill disaster, he says, the oil company “used the disaster to institute a culture of safety . . . designed to maintain the culture of safety and risk management even as memories of Valdez fade.”

We often do try to ensure that “this can never happen again.” After the 1980s, many intelligent and well-intentioned government officials went to work to enact regulatory safeguards. They didn’t work. As Arnold Kling pointed out in an insightful paper, “Not What They Had in Mind: A History of Policies that Produced the Financial Crisis of 2008,” some of the biggest reforms from the earlier time became central causes of the next crisis—a notable example of Ip’s conclusions.

We are forced to realize that the U.S. housing finance sector collapsed twice in three decades. We may ask ourselves, are we that incompetent?

Consider a financial system. The “system” is not just all the private financial actors—bankers, brokers, investors, borrowers, savers, traders, speculators, hucksters, rating agencies, entrepreneurs, principals and agents—but equally all the government actors—multiple legislatures and central banks, the treasuries and finance ministries who must constantly borrow, politicians with competing ambitions, all varieties of regulatory agencies and bureaucrats, government credit and subsidy programs, multilateral bodies. All are intertwined and all interacting with each other, all forming expectations of the others’ likely actions, all strategizing.

No one is outside the system; all are inside the system. Its complexity leaves the many and varied participants inescapably uncertain of the outcomes of their interactions.

Within the interacting system, a fundamental strategy, as Ip says, is “to do something risky, then transfer some of the risk to someone else.” This seems perfectly sensible—say, getting subsidized flood insurance for your house built too near the river, or selling your risky loans to somebody else. But “the belief that they are now safer encourages them to take more risk, and so the aggregate level of risk in the system goes up.”

“Or,” he continues, “it might cause the risky activity to migrate elsewhere.” Where will the risk migrate to? According to Stanton’s Law, which seems right to me, “Risk migrates to the hands least competent to manage it.” Risk “finds the vulnerabilities we missed,” Ip writes. This means we are always confronted with uncertainty about what unforeseen vulnerabilities the risk will find.

Finally, the author puts all of this in a wider perspective. “My story, however, is not about human failure,” he writes, “it is about human success.” There can be no economic growth without risk and uncertainty. The cycles and crises will continue, so what we should look for is not utter stability but “the right trade-off between risk and stability.” The cycles and crises are “the price we pay for an economic system that encourages and rewards risk.” This seems to me profoundly correct.

Where is OCC in court battle over state usury limits?

Published in American Banker with William M. Isaac.

A surprising decision of the Second Circuit Court of Appeals in the case of Midland Funding v. Madden threatens the functioning of the national markets in loans and loan-backed securities. The ruling, if it stands, would overturn the more than 150-year-old guiding principle of “valid when made.”

The effects of the decision could be wide-ranging, affecting loans beyond the type at issue in the case. It is in the banking industry’s interest for the Supreme Court, at the very least, to limit its applicability. And since the Madden case could deal a blow to preemption under the National Bank Act, it is time for the Office of the Comptroller of the Currency to voice an opinion.

Under the valid-when-made principle, if the interest rate on a loan is legal and valid when the loan is originated, it remains so for any party to which the loan is sold or assigned. In other words, the question of who subsequently owns the financial instrument does not change its legal standing. But the appeals court found that a debt buyer does not have the same legal authority as the originating bank to collect the stated interest.

In the words of the amicus brief filed before the U.S. Supreme Court on behalf of several trade associations:

Since the first half of the nineteenth century, this Court has recognized the ‘cardinal rule’ that a loan that is not usurious in its inception cannot be rendered usurious subsequently. ” U.S. credit markets have functioned on the understanding that a loan originated by a national bank under the National Banking Act is subject to the usury law applicable at its origination, regardless of whether and to whom it is subsequently sold or assigned.

This, the argument continues, “is critically important to the functioning of the multitrillion-dollar U.S. credit markets.” So it is. And such markets are undeniably big, with hundreds of billions of dollars in consumer credit asset-backed securities, and more than $8 trillion in residential mortgage-backed securities, plus all whole loan sales.

Marketplace lenders and investors have already raised intense concerns about the decision, but the impact could go further. The validity of numerous types of loan-backed securities packaged and sold on the secondary market could suddenly be called into question. Packages of whole loans, as well as securitizations, include the diversified debt of multiple borrowers from different states with different usury limits, and then sold to investors. But the Madden decision suggests those structures are at risk of violating state usury laws.

A possible interpretation to narrow the impact of the case would be for future court decisions to find that the Madden outcome only applies to the specific situation of this case, namely to defaulted and charged-off loans sold by a national bank to an entity that is not a national bank. Thus, only the buyers of such defaulted debt would be bound by state usury limits in their collection efforts, and the impact will largely be limited to diminishing the value of such loans in the event of default.

The Second Circuit decision might not, based on this hypothesis, apply to performing loans or to the loan markets in general. However, as pointed out in a commentaryby Mayer Brown: “it will take years for the Second Circuit to distinguish Madden in enough decisions that the financial industry can get comfortable that Madden is an anomaly.” The law firm’s commentary presented many potential outcomes, including that the Madden case could be “technically overturned” but without the high court providing explicit support for the “valid-when-made” principle. That “would be a specter haunting the financial industry,” according to the firm’s analysis.

In the meantime, what happens?

It would be much better for the Supreme Court to reaffirm the valid-when-made principle as a “cardinal rule” governing markets in loans, and the Supreme Court is being petitioned to accept the case for review.

But at this point, one would also expect the OCC, the traditional defender of the powers of national banks and the preemption of state constraints on national bank lending, to be weighing in strongly. The comptroller of the currency should protect the ability of national banks to originate and sell loans guided by the valid-when-made principle. But the OCC seems not to be weighing in at all and is strangely absent from this issue.

Everyone agrees that national banks can make loans under federal preemption of state statutes, subject to national bank rules and regulations. Everyone agrees, as far as we know, that the valid-when-made principle is required for loans to move efficiently among lenders and investors in interstate and national markets, whether as whole loans or securities.

In our view, the OCC ought to be taking a clear and forceful public position to support the ability of national banks to originate loans which will be sold into national markets.

Puerto Rico: Time for Congress to act

Published by the R Street Institute.

The finances of Puerto Rico’s government are unraveling rapidly. With the commonwealth government broke and scrambling, its Legislative Assembly already has empowered Gov. Alejandro García Padilla to declare a moratorium on all debt payments.

In a report that was kept secret, the Government Development Bank, which is at the center of complex intragovernmental finances, was found last year to be insolvent. Adding together the explicit government debt and the liabilities of its 95 percent unfunded government pension plan, the total problem adds up to about $115 billion.

There is no pleasant outcome possible here. The first alternative available is to deal with many hard decisions and many necessary reforms in a controlled fashion. The second is to have an uncontrolled crisis of cascading defaults in a territory of the United States.

Congress needs to choose the controlled outcome by creating a strong emergency financial control board for Puerto Rico—and to do it now. This is the oversight board provided for in the bill currently before the House Natural Resources Committee. The bill further defines a process to restructure the Puerto Rican government’s massive debts, which undoubtedly will be required.

Some opponents of the bill, in a blatant misrepresentation, have been calling it a “bailout” to generate popular opposition. To paraphrase Patrick Henry, these people may cry: Bailout! Bailout!…but there is no bailout.

Enacting this bill is the first step to get under control a vast financial mess, the result of many years of overborrowing, overlending and financial and fiscal mismanagement.

Again to cite Patrick Henry, “Why stand we here idle?”

Puerto Rico bill proceeds with oversight board and no bailout

Published by the R Street Institute.

The House Natural Resources Committee is taking testimony today on its bill to address the Puerto Rico debt crisis, and could send a finished bill to the full U.S. House as early as tomorrow. As the Puerto Rican government’s finances continue to unravel rapidly, it is decidedly time for Congress to act.

The bill gets two fundamental issues right. It takes the essential first step: creating a strong emergency financial control board to oversee and reform the Puerto Rican government’s abject financial situation and operations. The oversight board the bill provides should be put in place as soon as possible. (See “Puerto Rico needs a financial control board.”)

Second, it provides no bailout for the bondholders. Should U.S. taxpayers provide a bailout to those who unwisely lent money to the Puerto Rican government? Clearly not. When governments spend and borrow themselves into insolvency, those who provide the debt should bear the risk on their own. Since the citizens of Puerto Rico themselves pay no federal income taxes, this imperative is even stronger.

Objections are raised that these losing investments were made while relying on the Puerto Rican government’s inability to enter bankruptcy proceedings. But the fact that you cannot enter bankruptcy does not stop you from going broke. When you are broke, and the cash is gone, and the lenders won’t lend to you any more, the question becomes how big a loss the various parties will take. Nobody knows the right answer at this point: that’s one of the reasons we need the oversight board.

The Puerto Rican government has now made settlement offers for outstanding debt which would pay, on average, about 66 cents to 75 cents on the dollar. For the debt held by its own residents, it offers a special deal: you could be paid at par, starting 49 years from now, and get an interest rate of 2 percent. Discounted at 5 percent, this implies a value of about 45 cents on the dollar. Presumably, this would be a way to avoid recognizing losses for Puerto Rican credit unions which would not mark to market.

There are three contenders for the vanishing cash of the Puerto Rican government: the creditors, the ongoing operations of the government and the beneficiaries of the large and virtually unfunded government pension plan. How to share the losses among the claimants is the fight at the center of all insolvencies and will be so in this one, too.

There is no pleasant way out of the current situation. We won’t even know how deep the component insolvencies are until the oversight board gets in there and figures it out. In the meantime, we also should wrestle with the third fundamental issue: how to create a successful market economy to replace Puerto Rico’s current failed government-centric one.

Update on U.S. property prices in the Fed’s brave new world

The attached policy short was published in the Spring 2016 edition of Housing Finance International, the quarterly journal of the International Union for Housing Finance.

Readers of my last update in Housing Finance International may recall this principle: The collateral for a home mortgage loan is not the house, but the price of the house. Likewise, the collateral for a commercial real estate loan is not the property, but the price of the property.

A key question always accompanies this principle: How much can asset prices change? The answer is always: More than you think. Prices can go up more than you expected, and they can go down a lot more than you thought possible; a lot more than your “worst case scenario” projected. The more prices have gone up in the boom, and the more leverage has been induced by their rise, the more likely are their subsequent fall and the bust.

From this, we can see how dangerous a game the Federal Reserve and other major central banks have played by promoting asset price inflation through their monetary manipulations of the last several years. Unavoidably, among the asset prices affected are those of residential and commercial real estate.

The Fed has tried asset price inflation before. In the wake of the collapse of the tech stock bubble in 2000, under then-Chairman Alan Greenspan, the Fed set out to promote a housing boom in order to create a “wealth effect” that would offset the recessionary effects of the previous bubble’s excesses. I call this the Greenspan Gamble. As we know, the boom got away into a new and far more damaging bubble. It was in fact a simultaneous double bubble in housing and in commercial properties. This is made apparent in Graph 1, showing the decade from 2000-2010. These events stripped Greenspan of his former masterful aura and of his former media title, “The Maestro.”

The economically sluggish aftermath of the twin bubbles brought us, under Greenspan’s successor, Ben Bernanke, the Bernanke Gamble. The Fed once again set about promoting asset price inflation and “wealth effects” to offset the financial and economic drag of the previous excesses. The brave new world of the Bernanke Gamble includes exceptionally low interest rates, years of negative real short-term interest rates, and the effective expropriation of savers, while making the Fed into the biggest investor in mortgage assets in the world. Of course this has inflated real estate prices.

Graph 2 shows U.S national average house prices from 1987 to 2015 and their trend line. The bubble’s extreme departure from the trend is obvious. It is essential to observe that the six years of price deflation, from the peak in 2006 to 2012, while a 27 percent aggregate fall, brought house prices only back to their trend line – there was very little downside overshoot. Since 2012, prices have risen by 31 percent in less than four years, and are now 12 percent over their trend line. This rate of increase is unsustainable. On top of that, the U.S. government is once again, as it did the last time around, pushing mortgage loans with small down payments and greater credit risk. Some politicians have apparently learned nothing and forgotten everything.

The price behavior of commercial real estate has been even more extreme. As shown in Graph 3, while commercial real estate prices peaked in 2008 at a level similar to that of housing in 2006, their fall was much steeper, dropping 40 percent, or about half again as much as house prices. The difference presumably reflects the large government efforts to prop up the prices of houses.

From the 2010 bottom in commercial real estate prices, they have now almost doubled, and the current index is 17 percent above the prices at the peak of the bubble. Cranes are busy, and this so far makes the Fed happy, since it means strong construction spending. But what comes next?

Asset prices need to be understood on an inflation-adjusted basis. Over long periods of time, the inflation-adjusted increase in U.S. house prices is very modest – only about 0.6 percent per year, on average. This means home ownership is a good long-term hedge against the central bank’s endemic inflation, but on average, not a great investment. Graph 4 shows real house price movements over 40 years, from 1975 to 2015, stated in constant 2000 dollars, and the modestly increasing long-term trend line. As of the end of 2015, average house prices are 19 percent above the inflation-adjusted trend – not yet a bubble, but distinctly a renewed boom.

Rapid increases in house and commercial real estate prices is what in the past has induced extrapolations of further price increases, looser credit standards, increasing leverage, and overconfidence among lenders and borrowers. We can only hope that this time they remember that it is the price, not the property, which is being leveraged.

Will the Bernanke Gamble end in similar fashion to the Greenspan Gamble? Will the historical average of a financial crisis about every 10 years continue? We will find out.

Your retirement dream may require working much longer

Published in Real Clear Markets.

A recent Citigroup monograph, “The Coming Pensions Crisis,” begins with some questions very much in the spirit of our time: “What’s your dream for retirement? Is it living on the beach, traveling on cruise ships…relaxing and enjoying the good life”?

Personally speaking, my dream for retirement is not to retire—at least, not now. I think if Warren Buffett can keep running the world’s greatest investment company at 85, and Alan Greenspan could run the world’s most powerful central bank until 79 before going on to lecture and write books, and Maurice R. “Hank” Greenberg can be battling the goliath of the government at 90, why would I stop at 73? How much sitting on the beach, going on cruises and relaxing can you stand?

What, after all, is “the good life”?

As used by Citigroup, “the good life” means consuming without producing. The words of an old hymn admonish us to “work, for the night is coming.” Here the suggestion is instead: “play, for the night is coming.”

I understand that tastes differ, so may you may prefer the latter. But no one can escape the accompanying question: how many years can you afford to play without working, to consume without producing? If you retire at 63 and live to 85, you will have been retired for a quarter of your life. Should you live to 95 instead, you will have been retired for a third of your life. On average, such an arrangement cannot work financially.

As average lives grow longer, “the reality for many of us,” Citigroup rightly says, “is that there isn’t enough in the piggy bank to last throughout their retired life.” The same problem confronts many pension funds, both private and public, upon which workers rely. They don’t have nearly enough money in the piggy bank, either—not by a long shot.

This daunting problem – in total, an $18 trillion shortfall, by Citigroup’s estimate – is staring us in the face. There are only two answers. Put more money in the piggy bank while you are working—and as retirements grow longer, this means a lot more. Or make the retired years fewer by working longer. Or both. The math of the matter all comes down to this.

An essential element in the math is what I call the “W:R Ratio,” which measures how many years you work compared to how many years you will be retired. All the money spent in retirement is the result of what is saved, in one fashion or another, during one’s working years. This may be what you personally saved and invested, or what your employer subtracted from your compensation and invested, or the money the government took from your compensation and spent, but promised to pay back later.

The surest way to finance your retirement is to keep your W:R ratio up by not retiring too soon.

In 1950, the average age of retirement in the United States was 67. Average life expectancy at birth was 68. Average life expectancy for those who reaches age 65 was 79. Suppose you started work at 20 and retired at 67—working 47 years and ultimately living to age 79. Your W:R ratio was 47 working years divided by 12 retired years, or 3.9. You worked and could contribute to savings for about four years for every year of retirement.

Contrast the current situation. The average retirement age is much lower, at 63. Average life expectancy once you get to 65 is up to 86. Retirement has gotten longer from both ends. Also, many more people have post-secondary education and begin work later. Suppose you work from 22 to 63-years-old and live to age 86. Your W:R ratio is 41 divided by 23, or only 1.8. You have worked less than two years for each year of retirement. Can that work financially? No.

So the crux of the W:R relationship is: how many years do you have to work in order to save enough to pay your expenses for one year of retirement? What is your guess? One year of work for one year of retirement—say retiring after 30 years at 55 and living to 85? No way. Two years? That would take a heroic and implausible savings rate.

Calculations show that with retirement savings of about 10 percent of income, and historically average real returns of 4 percent a year on the invested savings, the W:R ratio needs to be 3:1. That means if you start working at 22 and live to 86, the financeable retirement age is 70. Or if you start work at 25, the financeable retirement age is 71. All of this is speaking of averages, of course, not necessarily in any individual case.

If the savings are lower, the rate of return is lower or both, the W:R ratio and the age of retirement must rise even more. The Federal Reserve is now making the problem much worse for retirement savings with low, zero or negative real interest rates. We have to hope this expropriation of savers by the Fed is temporary, historically speaking.

What certainly proved to be temporary was the idea that those still in good health and capable in many cases of productive work in a service economy should instead expect to be paid comfortably for long years of play. When combined with greatly extended longevity, this 1950s dream was simply unrealistic; indeed, it was impossible. Today’s savings and pension fund shortfalls bear witness to this financial reality. We must adjust our expectations and plans back to higher average W:R ratios and later retirements than in recent times.

On Puerto Rico, Congress is moving in the right direction

Published by the R Street Institute.

The draft bill to address Puerto Rico’s debt crisis – released late last week by House Natural Resources Committee Chairman Rob Bishop, R-Utah – marks a step in exactly the right direction. It realistically faces the fact that the government of Puerto Rico has been unable to manage its own finances, has constantly borrowed to finance its deficits and is now broke.

What is to be done as the Puerto Rican government displays its inability to cope with its debt burden — which, adding together its explicit debt plus its 95 percent unfunded pension liabilities, totals about $115 billion?

As the draft bill provides, the first required step is very clear: Congress must create a strong emergency financial-control board (“oversight board” is the draft’s term) to assume oversight and control of the commonwealth’s financial operations. This is just as Congress did successfully with the insolvent District of Columbia in 1995; what New York State, with federal encouragement, did with the insolvent New York City in 1975; and what the State of Michigan did with the appointment of an emergency manager for the insolvent City of Detroit in 2013. Such actions have also been taken with numerous other troubled municipal debtors. They are hardly an untried idea.

This should be the first step. As the bill provides, other steps will need to follow. To begin, the oversight board will need to establish independent authority over books and records, publish credible financial statements, and determine the extent of the insolvency of the various parts in the complex tangle of Puerto Rican government borrowing entities—especially of the Government Development Bank, which lends to the others. Then it will have to help develop fiscal, accounting, tax-collection and structural reforms that lead to future fiscal balance.

The oversight board will have to consider and report to Congress on the best ways to deal with the current excessive and unpayable debt, including pension liabilities. The draft bill provides a key role for the board in debt restructuring issues.

Puerto Rico has a failing, government-centered, dependency-generating political economy. The draft bill envisions the oversight board assisting with economic revitalization, which will be a key consideration going forward.

Needless to say, the current government of Puerto Rico does not like the idea of having its power and authority reduced. But this always happens to those who fail financially. The people of Puerto Rico understand this: 71 percent in a recent University of Turabo poll favored “a fiscal control board…that has broad powers.” In time, revitalized finances will lead to a more successful local government.

The draft bill is headed for introduction and hearings. Stay tuned.

Sizing up the FCIC report five years later

Published by the R Street Institute.

Ongoing debates about the financial crisis of 2007 to 2009 keep reminding us that economics is not a science. It can’t be used by governments to manage economic and financial affairs to some preordained outcome. Not only is it rather poor at predicting the future, but its practitioners often are unable to agree even on how to interpret the past.

Nonetheless, accepted economic stories or myths do get established in the media and political mind. One example from a different crisis is that Herbert Hoover was a donothing president in the face of the developing depression. In fact, he was an energetic and ardent interventionist. The real question is whether his many interventions were good or bad.

What are the myths of our more recent crisis?

When it comes to the Financial Crisis Inquiry Commission, created by Congress in May 2009 to study the causes of the crisis, we must remember that the “report” the 10-member commission finally delivered in January 20112 was actually three separate reports:

The majority report, voted for by the six Democratic-appointed commissioners and no Republican-appointed commissioners, essentially concluded the primary cause was insufficient government intervention.

A minority dissent of three of the Republican-appointed commissioners concluded the causes of the crisis were many and interacting, with plenty of blame to go around.

A separate dissent by Peter Wallison argued in detail that the biggest problem was too much government intervention, resulting in extreme distortions in housing-finance market.

In the five years since these reports, what more have we learned? From this distance, can we put the FCIC’s majority and dissenting reports, and the crisis itself, into a convincing overall perspective?

The R Street Institute convened panel of experts, including two former FCIC members, for a Feb. 4, 2016 conference on these issues. The gathering served to provide an informed, insightful and provocative discussion. We are pleased to present this summary of their presentations.

The temptations of housing finance bubbles

A version of this policy short originally appeared in the Winter 2015 issue of the journal Housing Finance International.

Running up the leverage is the snake in the housing finance Garden of Eden. It is a constant set of alluring temptations to enjoy the fruit of increased risk in the medium term, while setting ourselves up for the inevitable fall.

Let us view this famous painting by Lucas Cranach:

The woman is Fannie Mae. The man is Freddie Mac. The snake is whispering, “If you just run up the leverage of the whole housing finance system, you will become powerful and rich.” Fannie and Freddie are about to eat the apple of risk, which will indeed make them very powerful and very rich for a while, after which they will be shamed, humiliated and punished.

Bubbles in housing finance have occurred in many countries and times. They always end painfully, yet they keep happening. As the prophet said (slightly amended), “There is nothing new under the financial sun. The cycle that hath been, it is that which shall be.” Why is this?

Consider this quotation: “The [banking] failures for the current year have been numerous…In many cases, however, the unfavorable conditions were greatly aggravated by the collapse of unwise speculation in real estate.” What year was that? It could have been 2008, to be sure, but it is actually from 1891, as the then-U.S. comptroller of the currency looked sadly at the wreck of many of the banks of his day.

Some people say the problem is that housing lenders who go broke need to be personally punished, to get their incentives right. Economists are big, not without reason, on worrying about economic incentives. But a bigger problem is that it is so hard to know the future. Housing lenders don’t create housing-finance collapses on purpose, but by mistake.

The city of Barcelona in the 14th century decided to manage the incentives of bankers by decreeing that those who defaulted on their deposits would be subject to capital punishment. And as one financial history tells us, “at least one banker, Francesch Castello, was beheaded directly in front of his counter in 1360.” But this did not stop banks from failing.

One of the most important reasons that housing-finance bubbles are so hard to control is that they make nearly everyone happy while they last. Who is making money from a housing-finance bubble? Almost everybody. This is why the experience of a bubble is so insidious.

For example, take the most recent American experience. For a long time, the seven years of 2000-2006, the housing-finance bubble generated profits and wealth. A lot of the profits and wealth turned out to be illusory in the end, but at the time, some of it was real and all of it seemed real. As house prices rose, borrowers made more money if they bought more expensive houses with the maximum amount of leverage. Property flippers bought and sold condominiums for quick and repetitive profits, even if no one was living in them. Housing lenders had big volumes and profits. Their officers and employees got big bonuses. Numerous officers of Fannie Mae and Freddie Mac made more than $1 million a year each. Real estate brokers had high volumes and big commissions. Equity investors saw the value of their housing-related stocks go up. Fixed-income investors all over the world enjoyed the returns from subprime mortgage-backed securities, which seemed low risk, and from Fannie Mae and Freddie Mac securities, which seemed to be, and actually were, guaranteed by the U.S. government.

Most importantly, the 75 million households that were homeowners saw the market price of their houses keep rising. This felt like, and was discussed by economists as, increased wealth. Of course, this was politically popular. The new equity in their houses at then-market prices allowed many consumers to borrow on second mortgages and home-equity loans, so they could spend money they had not had to earn by working. Then-Federal Reserve Chairman Alan Greenspan smiled approvingly on this housing “wealth effect,” which was offsetting the recessionary effects of the collapse of the previous bubble in technology stocks in 2000.

Homebuilders profited by a boom in new building. Local governments got higher real-estate-transaction taxes and greater property taxes, which reflected the increased tax valuations of their citizens’ houses. They could increase their spending with the new tax receipts. The investment banks, which pooled mortgages, packaged them into ever more complex mortgage-backed securities, and sold and traded them, made a lot of money and paid big bonuses to the members of their mortgage operations, including the former physicists and mathematicians who built the models of how the securities were supposed to work. Bond-rating agencies were paid to rate the expanding volumes of mortgage-backed securities and were highly profitable. Bank regulators happily noted that bank capital ratios were good, and that zero banks failed in the United States in the years 2005 and 2006 – the very top of the bubble. In the next six years, 468 U.S. banks would fail.