The temptations of housing finance bubbles

A version of this policy short originally appeared in the Winter 2015 issue of the journal Housing Finance International.

Running up the leverage is the snake in the housing finance Garden of Eden. It is a constant set of alluring temptations to enjoy the fruit of increased risk in the medium term, while setting ourselves up for the inevitable fall.

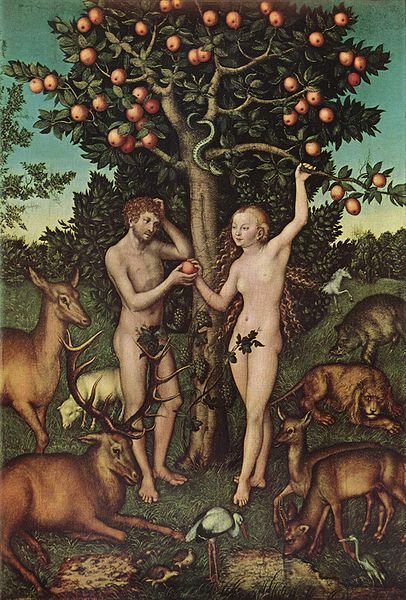

Let us view this famous painting by Lucas Cranach:

The woman is Fannie Mae. The man is Freddie Mac. The snake is whispering, “If you just run up the leverage of the whole housing finance system, you will become powerful and rich.” Fannie and Freddie are about to eat the apple of risk, which will indeed make them very powerful and very rich for a while, after which they will be shamed, humiliated and punished.

Bubbles in housing finance have occurred in many countries and times. They always end painfully, yet they keep happening. As the prophet said (slightly amended), “There is nothing new under the financial sun. The cycle that hath been, it is that which shall be.” Why is this?

Consider this quotation: “The [banking] failures for the current year have been numerous…In many cases, however, the unfavorable conditions were greatly aggravated by the collapse of unwise speculation in real estate.” What year was that? It could have been 2008, to be sure, but it is actually from 1891, as the then-U.S. comptroller of the currency looked sadly at the wreck of many of the banks of his day.

Some people say the problem is that housing lenders who go broke need to be personally punished, to get their incentives right. Economists are big, not without reason, on worrying about economic incentives. But a bigger problem is that it is so hard to know the future. Housing lenders don’t create housing-finance collapses on purpose, but by mistake.

The city of Barcelona in the 14th century decided to manage the incentives of bankers by decreeing that those who defaulted on their deposits would be subject to capital punishment. And as one financial history tells us, “at least one banker, Francesch Castello, was beheaded directly in front of his counter in 1360.” But this did not stop banks from failing.

One of the most important reasons that housing-finance bubbles are so hard to control is that they make nearly everyone happy while they last. Who is making money from a housing-finance bubble? Almost everybody. This is why the experience of a bubble is so insidious.

For example, take the most recent American experience. For a long time, the seven years of 2000-2006, the housing-finance bubble generated profits and wealth. A lot of the profits and wealth turned out to be illusory in the end, but at the time, some of it was real and all of it seemed real. As house prices rose, borrowers made more money if they bought more expensive houses with the maximum amount of leverage. Property flippers bought and sold condominiums for quick and repetitive profits, even if no one was living in them. Housing lenders had big volumes and profits. Their officers and employees got big bonuses. Numerous officers of Fannie Mae and Freddie Mac made more than $1 million a year each. Real estate brokers had high volumes and big commissions. Equity investors saw the value of their housing-related stocks go up. Fixed-income investors all over the world enjoyed the returns from subprime mortgage-backed securities, which seemed low risk, and from Fannie Mae and Freddie Mac securities, which seemed to be, and actually were, guaranteed by the U.S. government.

Most importantly, the 75 million households that were homeowners saw the market price of their houses keep rising. This felt like, and was discussed by economists as, increased wealth. Of course, this was politically popular. The new equity in their houses at then-market prices allowed many consumers to borrow on second mortgages and home-equity loans, so they could spend money they had not had to earn by working. Then-Federal Reserve Chairman Alan Greenspan smiled approvingly on this housing “wealth effect,” which was offsetting the recessionary effects of the collapse of the previous bubble in technology stocks in 2000.

Homebuilders profited by a boom in new building. Local governments got higher real-estate-transaction taxes and greater property taxes, which reflected the increased tax valuations of their citizens’ houses. They could increase their spending with the new tax receipts. The investment banks, which pooled mortgages, packaged them into ever more complex mortgage-backed securities, and sold and traded them, made a lot of money and paid big bonuses to the members of their mortgage operations, including the former physicists and mathematicians who built the models of how the securities were supposed to work. Bond-rating agencies were paid to rate the expanding volumes of mortgage-backed securities and were highly profitable. Bank regulators happily noted that bank capital ratios were good, and that zero banks failed in the United States in the years 2005 and 2006 – the very top of the bubble. In the next six years, 468 U.S. banks would fail.

The politicians are not to be forgotten. The politicians trumpeted and took credit for the increasing home ownership rate, which the housing finance bubble temporarily carried to 69 percent, before it fell back to its historical level of 64 percent. The politicians pushed for easier credit and more leverage for riskier borrowers, which they praised as “increasing access” to borrowing. (The snake had most certainly been whispering to the politicians, too.)

The bubble was highly profitable for everybody involved – as long as the house prices kept going up. As long as house prices rise, the more everybody borrows, the more money everybody makes. This general happiness creates a vast temptation to keep the leverage increasing at all levels.

This brings us to two essential questions.

The first is: What is the collateral for a mortgage loan?

Most people answer, “That’s easy – the house.” But that is not the correct answer.

The correct answer is: Not the house, but the price of the house. The only way a housing lender can recover from the property is by selling it at some price.

The second key question is: How much can a price change? To this question, the answer is: A lot more than you think. It can go up a lot more than you expected, and it can then go down a lot more than you thought possible. It can go down a lot more than your worst-case planning scenario dared to contemplate.

So the temptations of housing-finance bubbles generate mistaken beliefs about how much prices can go down. American housing experts knew that house prices could fall on a regional basis, but most were convinced that house prices would not fall on a national average basis. Of course, now we know they were wrong, and that national average house prices fell by 30 percent. And they fell for six years.

By then, Fannie Mae and Freddie Mac had been banished from their pleasant housing finance Garden of Eden. Here they are, being sent into government conservatorship, as depicted by Michelangelo:

In conservatorship they remain to this day, more than seven years after their failure. Having played a key role in running up the leverage of the whole system, they had suffered a fall they never thought possible.