Tags

Financial Systemic Issues: Booms and Busts - Central Banking and Money - Corporate Governance - Cryptocurrencies - Government and Bureaucracy - Inflation - Long-term Economics - Risk and Uncertainty - Retirement Finance

Financial Markets: Banking - Banking Politics - Housing Finance - Municipal Finance - Sovereign Debt - Student Loans

Categories

Blogs - Books - Op-eds - Letters to the editor - Policy papers and research - Testimony to Congress - Podcasts - Event videos - Media quotes - Poetry

Treasury should not bail out Fannie and Freddie’s subordinated debt

Published in Economics 21.

When the U.S. Treasury bailed out Fannie Mae and Freddie Mac in 2008, holders of $13.5 billion in Fannie’s and Freddie’s subordinated debt—debt paid off after senior debt is repaid—were completely protected. Instead of experiencing losses to which subordinated lenders can be exposed when the borrower fails, they got every penny of scheduled payments on time.

The structural reasons for the unusual occurrence should be carefully examined by the Treasury to avoid its repetition.

This outcome was the exact opposite of the academic theories that had for years pushed subordinated debt as the way to create market discipline for financial firms that benefit from government guarantees on their senior obligations. In the event, Fannie’s and Freddie’s subordinated debt produced, and its holders experienced, zero market discipline. So much for the academic theories, at least as applied to government-sponsored enterprises.

“Perhaps surprisingly,” a Federal Reserve 2015 post-mortem study of the bailout says, “the two firms maintained their payments on the relatively small amount of subordinated debt they had.”

In terms of the theory that subordinated debt will be fully at risk, this is very surprising. As economist Douglas Elmendorf, former director of the Congressional Budget Office, wrote in criticism of this bailout detail, “The crucial role of subordinated debt for any company is to create a group of investors who know they will lose if the company fails.” But the Fannie and Freddie bailout was structured so that it didn’t happen.

The $13.5 billion is certainly a material number. While small relative to Fannie’s and Freddie’s immense liabilities, it was a significant part of their overall capital structure. In June 2008, Fannie and Freddie combined reported common equity of $18.3 billion and preferred stock of $35.8 billion, giving them, with the subordinated debt, total capital of $67.6 billion. The subordinated debt was thus 20 percent of reported total capital at that point, but it did not carry out its function as capital.

“In fact, subordinated debt is part of regulatory capital since the Basel I Accord (1988) and was always meant to absorb losses,” says a 2016 study for the European Parliament. Fannie and Freddie were not subject to the Basel Accord, but this nicely states the general theory.

“Market discipline is best provided by subordinated creditors,” wrote banking expert Paul Horvitz in 1983. A Federal Reserve study group produced the report “Using subordinated debt as an instrument of market discipline” in 1999. In 2000, Fed economists considered “a number of regulatory reform proposals aimed at capturing the benefits of subordinated debt” and concluded that it would indeed provide market discipline. “Ways to enhance market discipline… focused in large part on subordinated debt,” as a study by Fannie and Freddie’s regulator observed. Consistent with these theories, in October 2000, Fannie and Freddie committed to begin issuing publicly traded subordinated debt, and did. But bailout practice turned out to be inconsistent with the theory.

The Treasury knew precisely what it was doing for the subordinated debt holders. “These agreements support market stability,” said then-Treasury Secretary Henry Paulson’s Sept. 7, 2008 statement about the bailout, “by providing additional security and clarity to GSE debt holders—senior and subordinated—and support mortgage availability by providing additional confidence to investors…etc.” Treasury slipped that “and subordinated” in there in the middle of the paragraph, without any further comment or explanation.

“Under the terms of the agreement,” Paulson continued, “common and preferred shareholders bear losses ahead of the new government senior preferred shares.” But the government’s new senior preferred shares would by definition bear losses ahead of the subordinated debt. Why have the taxpayers be junior to the subordinated debt?

It appears that the Treasury was trapped as an unintended result of the Fannie and Freddie reform legislation of earlier in that bailout year, the Housing and Economic Recovery Act of 2008. A major battle in the creation of that act was to include the potential for receivership for Fannie and Freddie in the event of their failure—so, in theory, the creditors would have to consider the possibility of loss. Overachieving, Congress in HERA Section 1145 made receivership not just possible, but mandatory, in the event that Fannie and Freddie’s liabilities exceeded their assets and the regulator confessed it.

But in the midst of the financial crisis, the last thing Treasury wanted was a receivership, because the last thing they it wanted was to panic the creditors around the world by the prospect that they would be taking losses on Fannie’s and Freddie’s trillions of dollars of senior debt and MBS. Instead, they wanted to convince these creditors that there would be no losses. Treasury theoretically could have arranged to guarantee all the senior debt and MBS formally, but that would have forced the U.S. government to admit on its official books that it had an additional $5 trillion of debt. That would have been honest bookkeeping, but was an obvious nonstarter politically.

Once having decided against receivership, Treasury had to put the taxpayers’ money in as equity. Officials calculated that if Fannie and Freddie’s net worth were zero, their liabilities would not exceed their assets, so kept putting in enough new equity to bring the equity capital to zero. But once they had done that, there was no way to give the subordinated debt a haircut.

“We have been directed by FHFA to continue paying principal and interest on our outstanding subordinated debt,” Fannie reported. The covenants of the subordinated debt provided that if it were not being paid currently, no dividends could be paid by Fannie and Freddie—that would have included dividends on the Treasury’s senior preferred stock.

One reform idea, the mandatory receivership, had knocked out the previous reform idea that subordinated debt must take losses, and neither happened.

So financial theory notwithstanding, Fannie and Freddie’s subordinated debt achieved nothing. Its holders got a premium yield but were fully protected by the U.S. Treasury. The purchasers had made a very good bet on the financial behavior of governments when confronted with the failings of government-sponsored enterprises.

The 10th year since the bailout of Fannie and Freddie, and of their subordinated debt, will begin in September. Will Treasury now begin to address the structural issues?

How big a bank is too big to fail?

Published by the R Street Institute.

The notion of “too big to fail”—an idea that would play a starring role in banking debates from then to now—was introduced by then-Comptroller of the Currency Todd Conover in testimony before Congress in 1984. Conover was defending the bailout of Continental Illinois National Bank. Actually, since the stockholders lost all their money, the top management was replaced and most of the board was forced out, it was more precisely a bailout of the bank’s creditors.

Continental was the largest crisis at an individual bank in U.S. history up to that time. It has since been surpassed, of course.

Conover told the House Banking Committee that “the federal government won’t currently allow any of the nation’s 11 largest banks to fail,” as reported by The Wall Street Journal. Continental was No. 7, with total assets of $41 billion. The reason for protecting the creditors from losses, Conover said, was that if Continental had “been treated in a way in which depositors and creditors were not made whole, we could very well have seen a national, if not an international crisis the dimensions of which were difficult to imagine.” This is the possibility that no one in authority ever wants to risk have happen on their watch; therefore, it triggers bailouts.

Rep. Stewart McKinney, R-Conn., responded during the hearing that Conover had created a new kind of bank, one “too big to fail,” and the phrase thus entered the lexicon of banking politics.

It is still not clear why Conover picked the largest 11, as opposed to some other number, although he presumably because he needed to make Continental appear somewhere toward the middle of the pack. In any case, here were the 11 banks said to be too big to fail in 1984, with their year-end 1983 total assets – which to current banking eyes, look medium-sized:

If you are young enough, you may not remember some of the names of these once prominent banks that were pronounced too big to fail. Only two of the 11 still exist as independent companies: Chemical Bank (which changed its name to Chase in 1996 and then merged with J.P. Morgan & Co. in 2000 to become JPMorgan Chase) and Citibank (now Citigroup), which has since been bailed out, as well. All the others have disappeared into mergers, although the acquiring bank adopted the name of the acquired bank in the cases of Bank of America, Morgan and Wells Fargo.

The Dodd-Frank Act is claimed by some to have ended too big to fail, but the relevant Dodd-Frank provisions are actually about how to bail out creditors, just as was the goal with Continental. Thus in the opposing view, it has simply reinforced too big to fail. I believe this latter view is correct, and the question of who is too big to fail is very much alive, controversial, relevant and unclear.

Just how big is too big to fail?

Would Continental’s $41 billion make the cut today? That size now would make it the 46th biggest bank.

If we correct Continental’s size for more than three decades of constant inflation, and express it in 2016 dollars, it would have $97 billion in inflation-adjusted total assets, ranking it 36th as of the end of 2016. Is 36th biggest big enough to be too big to fail, assuming its failure would still, as in 1984, have imposed losses on hundreds of smaller banks and large amounts of uninsured deposits?

If a bank is a “systemically important financial institution” at $50 billion in assets, as Dodd-Frank stipulates, does that mean it is too big to fail? Is it logically possible to be one and not the other?

Let us shift to Conover’s original cutoff, the 11th biggest bank. In 2016, that was Bank of New York Mellon, with assets of $333 billion. Conover would without question have considered that—could he have imagined it in 1984—too big to fail. But now, is the test still the top 11? Is it some other number?

Is $100 billion in assets a reasonable round number to serve as a cutoff? That would give us 35 too big to fail banks. At $250 billion, it would be 12. That’s close to 11. At $500 billion, it would be six. We should throw in Fannie Mae and Freddie Mac, which have been demonstrated beyond doubt to be too big to fail, and call it eight.

A venerable theory of central banking is always to maintain ambiguity. A more recent theory is to have clear communication of plans. Which approach is right when it comes to too big to fail?

My guess is that regulators and central bankers would oppose anything that offers as bright a line as “the 11 biggest”; claim to reject too big to fail as a doctrine; strive to continue ambiguity; and all the while be ready to bail out whichever banks turn out to be perceived as too big to fail whenever the next crisis comes.

Sovereign debt has a pretty poor record

Published in the Financial Times.

Sir, “Nations have historically been the world’s best credits,” says your report “Supranational debt issuance on a high” (Aug. 10). This sanguine view is contradicted by Lex in the same issue: “the ‘doom loop’ between sovereign bonds and banks … remains intact” (“Sovereign debt/banks: risk, waiting”). One of these statements must be wrong, and the wrong one is the former.

In fact, the history of sovereign debt is pretty poor. Carmen Reinhart and Kenneth Rogoff, in This Time is Different, count over the past two centuries 250 defaults on external sovereign debt, which have of course continued up to the present. Sovereign debt created a financial crisis in Europe in this century; in Russia, Asia and Mexico in the 1990s; and a global debt crisis in the 1980s. There were vast sovereign defaults in the 1930s.

Max Winkler, in his Foreign Bonds: An Autopsy, summed up the history as follows: “The history of government loans is really a history of government defaults.

Fannie and Freddie face the moment of truth on their taxpayer bailouts

Published in The Hill.

Almost nine years ago, in September 2008, Fannie Mae and Freddie Mac were broke and put into government conservatorship by the Federal Housing Finance Agency. Less than two months before, the regulator had pronounced them “adequately capitalized.” As everybody knows, the U.S. Treasury arranged to bail them out with a ton of taxpayer money, ultimately totaling $187.5 billion, in order to get their net worth up to zero.

The original form of the bailout was senior preferred stock with a 10 percent dividend. By agreement between two parts of the government, the FHFA as conservator and the Treasury, the dividend was changed starting in 2013 from the original 10 percent to essentially 100 percent of the net profit of the two companies, whatever that turned out to be, in this notorious “profit sweep.”

By now, under the revised formula, Fannie and Freddie have paid in dividends to the Treasury $276 billion in total. That sounds like a lot more than $187.5 billion, a point endlessly repeated by the speculators in Fannie and Freddie’s still-existing common and junior preferred stock. Does this mean that Fannie and Freddie have economically, if not legally, paid off the Treasury’s investment? Nope. Not yet. But almost.

Let us suppose—which I believe to be the case—that the original 10 percent is a reasonable rate of return on the preferred stock for the taxpayers, who in addition got warrants for 79.9 percent of Fannie and Freddie’s common stock with an exercise price that rounds to zero. The 10 percent compares to the interest rate of 2 percent or so on 10-year Treasury notes and is greater than the average return on equity of 8 percent to 9 percent for banks in recent years.

The question is: When would all the payments by Fannie and Freddie to the Treasury constitute first a 10 percent annual yield on the preferred stock and then have been sufficient to retire all its par value with the cash that was left over?

This is easy to calculate. We lay out all the cash flows, all the investment that went into Fannie and Freddie from the Treasury, and all the dividends they paid to the Treasury, and calculate the cash-on-cash internal rate of return. When the internal rate of return gets to 10 percent, the economic payoff will have been achieved. I call this the “10 percent moment.”

As of the second quarter of 2017, the internal rate of return is 9.68 percent, so the 10 percent moment is close. If Fannie and Freddie pay the third quarter dividends they have projected, on a combined basis, the 10 percent moment will arrive in the third quarter of this year. The internal rate of return will have reached 10.02 percent.

However, viewing Fannie and Freddie separately, it is slightly more complex. Fannie is at 9.36 percent and should get to 10 percent by the fourth quarter of this year. Freddie has already made it, with an internal rate of return of 10.11 percent as of the second quarter of 2017.

At the 10 percent moment, let’s say the end of 2017, the Treasury could very reasonably and fairly consider its senior preferred stock as fully retired and agree to amend the agreements accordingly. Treasury should then also exercise all its warrants, to assure its 79.9 percent ownership of any future retained earnings and of whatever value the common stock may develop, guaranteeing the taxpayers the equity upside which was part of the original deal, and also assuring its voting control.

At that point, should it develop, the capital of Fannie and Freddie would still be zero. In this woefully undercapitalized state, they would still be regulated accordingly, and still be utterly dependent on the Treasury. They should begin immediately to pay a fee to the Treasury for its effective guaranty of their obligations. This fee should be charged on their total liabilities and be equivalent to what the Federal Deposit Insurance Corp. would charge a large bank with their level of capital for deposit insurance — for starters, a bank with zero capital.

There are a few other requirements for this new deal for Fannie and Freddie. They should immediately be designated as the large and “systemically important financial institutions” they so obviously are by the Financial Stability Oversight Board. The massive systemic risk they represent should be supervised by the Federal Reserve, and their minimum capital requirement should be set at a 5 percent leverage capital ratio.

They must immediately start complying with the law that sets their guarantee fees at the level which a private financial institution would have to charge to cover its cost of capital. This requirement for guarantee fees is clearly established in the Temporary Payroll Tax Cut Continuation Act of 2011. Finally, they should pay the relevant state and local corporate income taxes, like everybody else.

Under these conditions, with the profit sweep and the senior preferred stock gone, but also with most of their economic rents and special government favors removed, Fannie and Freddie would have a reasonable chance to see if they could become successful competitors. They would still be too big to fail, of course, but they would be paying a fair price for the privilege.

Virgin Islands follow Puerto Rico into the debt day of reckoning

Published by the R Street Institute.

What do Puerto Rico and the U.S. Virgin Islands have in common? They are both islands in the Caribbean, they are both territories of the United States and they are both broke.

Moreover, they both benefited (or so it seemed in the past) from a credit subsidy unwisely granted by the U.S. Congress: having their municipal bonds be triple-tax exempt everywhere in the country, something U.S. states and their component municipalities never get. This tax subsidy helped induce investors and savers imprudently to overlend to both territorial governments, to finance their ongoing annual deficits and thus to create the present and future financial pain of both.

Puerto Rico, said a Forbes article from earlier this year—as could be equally said of the Virgin Islands—“could still be merrily chugging along if investors hadn’t lost confidence and finally stopped lending.” Well, of course: as long as the lenders foolishly keep making you new loans to pay the interest and the principal of the old ones, the day of reckoning does not yet arrive.

In other words, both of these insolvent territories experienced the Financial Law of Lending. This, as an old banker explained to me in the international lending crisis of the 1980s, is that there is no crisis as long as the lenders are merrily lending. The crisis arrives when they stop lending, as they inevitably do when the insolvency becomes glaring. Then everybody says how dumb they are for not having stopped sooner.

Adjusted for population size, the Virgin Islands’ debt burden is of the same scale as that of Puerto Rico. The Virgin Islands, according to Moody’s, has public debt of $2 billion, plus unfunded government pension liabilities of $2.6 billion, for a total $4.6 billion. The corresponding numbers for Puerto Rico are $74 billion and $48 billion, respectively, for a total $122 billion.

The population of the Virgin Islands is 106,000, while Puerto Rico’s is 3.4 million, or 32 times bigger. So we multiply the Virgin Islands obligations by 32 to see how they compare. This gives us a population-adjusted comparison of $64 billion in public debt, and unfunded pensions of $83 billion, for a total $147 billion. They are in the same league of disastrous debt burden.

What comes next? The Virgin Islands will follow along Puerto Rico’s path of insolvency, financial crisis, ultimate reorganization of debt, required government budgetary reform and hoped for economic improvements.

A final similarity: The Virgin Islands’ economy, like that of Puerto Rico, is locked into a currency union with the United States from which, in my opinion, it should be allowed to escape. This would add external to the imperative internal adjustment, as the debt day of reckoning arrives.

The Fed should be required to provide Congress a regular savers’ impact analysis

Published by the R Street Institute.

Mr. Chairman, Ranking Member Moore and Members of the Committee,

Thank you for the opportunity to be here today. I am Alex Pollock, a senior fellow at the R Street Institute, and these are my personal views. I have spent more than four decades working in and on the banking system, including studying the role of central banks in both normal times and crises. I was president and CEO of the Federal Home Loan Bank of Chicago for 12 years, then worked on financial policy issues at the American Enterprise Institute, and moved to R Street last year.

I believe this hearing is examining a critical issue: What is the Federal Reserve doing to savers, notably including retirees?

To begin with my conclusion: Congress should require a savers’ impact analysis from the Federal Reserve at each discussion of the Fed’s policies and plans with the committees of jurisdiction. Under the CHOICE Act, this would be quarterly. This analysis should quantify, discuss and project for the future the effects of the Fed’s policies on savings and savers, so these effects can be explicitly considered along with other relevant factors.

Savings are essential to aggregate long-term economic progress and to personal and family financial well-being and responsibility. However, the American government’s policies, including those of the Federal Reserve, have subsidized and overemphasized the expansion of debt and have forgotten savings. The old theorists of savings and loans, to their credit, were clear that “savings” came first, and made possible the “loans.” Our current national policy could be described, instead of “savings and loans,” as “loans and loans.”

There is no doubt that among the very important effects of Federal Reserve actions from 2008 to now have been the expropriation of American savers, which has been especially painful for many retirees. This has been done through the imposition of negative real interest rates on savings during the remarkably long period of nine years, from 2008 to now. Negative real interest rates would be expected from the central bank in crisis mode, but it is a long time since that was over. The financial crisis ended in spring 2009, and the accompanying recession ended in June 2009, eight years ago. House prices bottomed in 2012—five years ago—and have reinflated rapidly. As we speak, they are back up over their bubble peak. The stock market has been on a bull run since 2009 and is at all-time highs. A logical question is: what is the Fed doing, still forcing negative real interest rates on savers at this point? The Fed should be required to explain to Congress, with quantitative specifics, what it has done, what it thinks it is doing and what it plans to do, in this respect.

Consumer price inflation year-over-year in May 2017 was 1.9 percent. The Federal Reserve endlessly announces to the world its intention to create perpetual inflation of 2 percent, which is equivalent to a plan to depreciate savings at the rate of 2 percent per year.

Against that plan, what yield are savers getting? The June 2017 Federal Deposit Insurance Corp. national interest rate report shows that the average interest rate on savings accounts is 0.06 percent. The national average money market deposit account rate is 0.12 percent, according to Bankrate, and the average three-month jumbo certificate of deposit 0.11 percent. Savers can do better than the averages by moving their money to the higher-yielding banks and instruments, but in no case can they get their yield up to anywhere near the inflation rate or the Fed’s annual inflation target. In the wholesale secondary market, for example, 90-day Treasury bills are yielding about 1 percent. And savers have to pay income taxes even on these paltry yields, making the negative real return worse.

Thrift, prudence and self-reliance, which should be encouraged, are instead being discouraged.

The CHOICE Act would require in general that the Federal Reserve be made more accountable, as it should be. No government entity, including the Fed, should be exempt from the constitutional design of checks and balances. To whom is the Fed accountable? To the Congress, of course, which created it, can abolish or redesign it and must oversee its tremendously powerful and potentially dangerous activities in the meantime. The savers’ impact analysis is fully consistent with the provisions of the bill.

The CHOICE Act would also require that new regulations provide “an assessment of how the burden imposed…will be distributed among market participants.” This excellent principle should also be applied to the Fed’s reports to Congress of what they are doing. In particular, the Fed has been taking money away from savers in order to give it to borrowers. This benefits borrowers in general, but notably benefits highly leveraged speculators in financial markets and real estate, since it has made financing their leverage close to free. Even more importantly, it benefits the biggest borrower of all by far—the government itself. Expropriating savers through the Federal Reserve is a way of achieving unlegislated taxation.

By my estimate, the Federal Reserve has taken since 2008 about $2.4 trillion from savers. The specific calculation is shown in the table at the end of this testimony. The table assumes savers could invest in six-month Treasury bills, then subtracts from the average interest rate on them the inflation rate, giving the real interest rate, which on average is -1.32 percent. This rate is then compared to the normal real interest rate, based on the 50-year average, giving us the gap the Fed has created between the actual real rates to savers and the historically normal real rates. This gap, which has averaged 2.97 percent, is multiplied by the total household savings. This gives us, by arithmetic, the total gap in dollars.

Let me repeat the answer: $2.4 trillion.

The Federal Reserve, I imagine, wishes to defend its sacrifice of the savers as a necessary evil, “collateral damage” in the course of pursuing the greater good. But there can be no doubt that taking $2.4 trillion from some people and giving it to others is a political decision and a political act. As a clearly political act, it should be openly and clearly discussed with the Congress, quantifying the effects on various sections of savers, borrowers and investors, and analyzing the economic and social implications.

The effects of the creation and manipulation of money pervade society, transfer wealth among various groups of people and can cause inflations, asset-price inflations and disastrous bubbles, which turn into busts. The money question is inherently political—it is political economics and political finance we are considering. Therefore, in developing and applying the theories and guesses with which it answers the money question, the Federal Reserve needs to be accountable to the Congress.

If you believed that the Federal Reserve had superior knowledge and insight into the economic and financial future, you could plausibly conclude that it should act as a group of philosopher-kings and enjoy independent power over the country. But no one should believe this. It is obvious that the Fed is just as bad at economic and financial forecasting as everybody else is. It is unable to predict the results of its own actions consistently. There is no evidence that it has any special insight. This is in spite of (or perhaps because of) the fact that it employs hundreds of Ph.D. economists, can have all the computers it wants (having no budget constraint) and can run models as complicated as it chooses.

Moreover, the notion of philosopher-kings is distinctly contradictory to the genius of the American constitutional design.

Seen in a broader perspective, the Federal Reserve is an ongoing attempt at price fixing and central planning by committee. Like all such efforts, naturally, it is doomed to recurring failure. It cannot know what the right interest rate is, and it cannot know how much of the losses of the bubble it is right to extract from savers.

Since the Fed cannot operate on knowledge of the future, it must rely on academic theories, in addition to flying by the seat of its pants. Its theories and accompanying rhetoric change over time and with changing personalities. Grown-up, substantive discussions with the Congress about which theories it is applying, what the alternatives are, who the winners and losers may be and what the implications are for political economy and political finance—just as the CHOICE Act suggests—would be a big step forward in accountability. Of course, we need to add a formal savers’ impact analysis.

The table calculating the cost imposed on savers by the Fed’s nine years of negative real interest rates is on the next page.

Thank you again for the chance to share these views.

Presentation to IUHF World Congress

This presentation on the topic of federal government intervention in the U.S. housing market was delivered by R Street Distinguished Senior Fellow Alex Pollock at the 30th International Union for Housing Finance World Congress in Washington, D.C.

Fed is far too dangerous to be unaccountable

Published in the Financial Times.

I would replace the headline of your editorial “An independent Fed had never been more crucial” (June 16) with a different thought: “Making the Fed accountable has never been more crucial.” The Federal Reserve is the most dangerous financial institution in the world, with an immense potential for disastrous mistakes. How can anyone believe that, as the discretionary manipulator of the world’s dominant fiat currency, it should be guided solely by the debatable and changing theories of a committee of economists? How can such a committee insist that it should be an independent power? Much wiser was former Fed chairman Marriner Eccles, the leader of the restructuring of the Fed in 1935, who referred to the Fed as “an agency of Congress.”

To qualify as an independent philosopher-king you have to be possessed of superior knowledge, but it is obvious that the Fed has none. It is equally as bad at forecasting the economic and financial future as everybody else. There is no evidence that it has any kind of superior insight. It does not know what the results of its own actions will be. That, combined with its capacity for damage, means it needs to be be made accountable in a system of governmental checks and balances, which is consistent with the American constitutional order.

The Fed needs to hold regular grown-up discussions with the Congress about what it thinks it is doing, what theories it is trying to apply, how its ideas are changing and which sectors are being hurt or helped by its actions. Your editorial worries about the effects of the politics such discussions might entail, but everything about the money question is, has been, and will be, political.

The Fed: Can the world’s biggest S&L get back to normal?

Published in the Library Of Law And Liberty

The balance sheet of today’s Federal Reserve makes it the largest 1980s-model savings and loan in the world, with a giant portfolio of long-term, fixed-rate mortgage securities combined with floating-rate deposits. This would certainly have astonished the legislative fathers of the Federal Reserve Act, like congressman and later Sen. Carter Glass, who strongly held that the Fed should primarily be about discounting short-term commercial notes.

It would equally have amazed the Fed’s past leaders, like its longest-serving chairman, William McChesney Martin, who presided over the Fed under five U.S. Presidents, from 1951 to 1969. Martin thought the Fed should confine its open-market activities to short-term Treasury bills and instituted the “bills only doctrine” in 1953. He would have been most surprised and we can imagine displeased at the amount of Treasury bills now included in the Fed’s bloated $4.5 trillion of assets. As of June 7, 2017, the Treasury bills held by the Fed are exactly zero. This is as radical on one end of the maturity spectrum as the long-term mortgages are on the other.

As part of its so-called “quantitative easing” program—a more respectable-sounding name for buying lots of bonds—the Fed reports its mortgage securities portfolio as $1.77 trillion as of June 7. Its investment is actually somewhat larger than that, since the Fed separately reports $152 billion of unamortized premiums net of discounts it has paid. If we guess half of those premiums are attributable to the MBS, the total becomes $1.85 trillion. The Fed owns 18 percent of all the first mortgages in the country, which total $10 trillion. It owns nearly 30 percent of all the Fannie Mae, Freddie Mac and Ginnie Mae MBS that are outstanding. It is big, a market-moving position, and that was indeed the idea: to move the market for MBS up, mortgage interest rates down and house prices up.

The Fed has in its portfolio $2.46 trillion of long-term Treasury notes and bonds. Adding in the other half of the unamortized premiums brings its investment to $2.54 trillion. The Fed owns 24 percent of all the Treasury notes and bonds that are in the hands of the public. Again, a remarkably large, market-moving position.

The Fed’s problem is now simple and obvious: once you have gotten into positions so big relative to the market and moved the market up, how do you get out without sending the market down? The Fed is expending a lot of rhetorical energy on this problem.

As Federal Reserve chairman half a century ago, Martin was rightly skeptical of the advice of academic economists, but the control of the Fed is now dominated by academic economists. The former gold standard, whose last vestige disappeared when the United States reneged on its Bretton Woods commitments in 1971, has been replaced by what James Grant aptly calls “the Ph.D. standard.”

The Ph.D. standard is accompanied by the strident insistence that the Fed must be entirely and unconstitutionally independent, so that it can carry out whatever monetary experiments the debatable theories of its committee of economists lead to. Since 2008, nine years ago, these theories have concluded that the Fed should create “wealth effects,” which means manipulating upward the prices of houses, bonds and equities by buying a lot of long-term securities. In promoting asset-price inflation, the Fed, in company with the other major central banks, has greatly succeeded. Is that good?

It is one thing to try this in the midst of a crisis and a deep recession. But the last recession ended in mid-2009, eight years ago. The stock market has been rising for eight years, since the first quarter of 2009, passed its 2007 high in 2013 and has been dramatically booming since. House prices bottomed in 2012, have been rising much faster than incomes for five years and are, amazingly, back over their 2006 bubble peak.

So why is the Fed still buying long-term mortgages and bonds? It is definitely still a big bid in both markets, because it is continuing to buy in order to replace all the maturities and prepayments in its huge portfolio. Why doesn’t it just stop buying, instead of endlessly talking about the possibility of stopping, eight years after the end of crisis? Well, the Fed’s leaders want to manage your expectations, so you won’t think it’s a big deal–they hope–when it finally does really stop buying.

That time has still not come, the Fed just announced June 14. Perhaps later this year, although even this timing was hedged, it expects to allow a slight bit of runoff—but not now! The Fed would then still be buying, but a little less. This “very gradual and predictable plan” would start with reducing securities purchases by $10 billion a month. Annualizing that rate, in a year, the portfolio would go from $4.4 trillion to $4.3 trillion.

The Fed will continue its status as the world’s biggest S&L.

The major central banks form a tight fraternity. They have all been engaged in long-term securities-buying programs, the ultimate effects of which are subject to high uncertainty. Predictable human behavior, when subject to high uncertainty, is to herd together, to have the comfort of having the colleagues you respect all doing the same thing you are doing. This includes all thinking the same way and making the same arguments, that is, cognitive herding. Central banks are clearly not exempt from this basic human trait.

To paraphrase a famous line of John Maynard Keynes, “a prudent banker is one who goes broke when everybody else goes broke.” A central banking variation might be, “a prudent central banker is one who makes mistakes when everybody else is making the same mistakes.” Will this turn out to be the case with the matching “quantitative easing” purchases they did together?

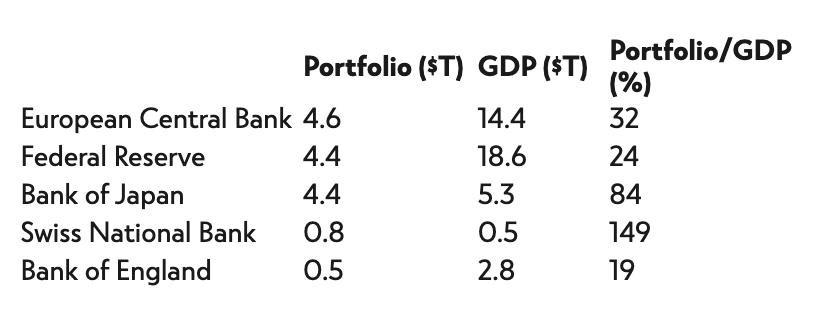

Here are the long-term securities portfolios of the elite of the central bank fraternity:

The European Central Bank has a slightly bigger bond portfolio than even the Fed does, but one significantly larger relative to the size of the economy. All these “quantitative easing” programs are definitely huge relative to the respective GDPs, the champion being the Swiss central bank with the remarkable size of 149 percent of gross domestic product. For better or worse, they are all in it together.

As a result of this massive central bank intervention, it is reasonably argued that there are no real market prices for bonds now—only central bank-manipulated prices. “Yields are too low in the U.S.,” as Abby Joseph Cohen of Goldman Sachs recently told Barron’s, and “there is no major economy with yields where they should be.”

What would happen to the Fed’s savings and loan-style balance sheet if interest rates did go back to normal? We know what happened to the savings and loan industry when interest rates went sharply up: they became insolvent. Could that happen to the Federal Reserve? Indeed. Let’s do the simple bond math.

What is the average duration of all the Fed’s long-term mortgages and bonds? A reasonable guess might be five years–if anything, this guess is easy on the Fed, and the duration of its mortgages will extend if rates rise. But let’s say five years. That means if long-term interest rates would rise by only 1 percent–not much—the market value of the Fed’s portfolio will fall by 1 percent x 5 = 5 percent. A 5 percent market loss on $4.4 trillion is $220 billion. Let’s compare that to the Federal Reserve System’s total capital, which is $40.8 billion. The Fed’s loss of market value on a 1 percent rise in long-term interest rates would be more than five times its capital.

Of course, interest rates might go up by more. A 2 percent rise would mean a market value loss of $440 billion, or more than 10 times the Fed’s capital. No wonder the Fed adamantly refuses to mark its securities portfolio to market!

Most economists confidently assert that no one would care at all if a fiat currency issuing central bank like the Fed became deeply insolvent on a mark-to-market basis. They may well be right. But in that case, why hide the reality of the market values?

The Swiss National Bank is required by its governing law to mark its securities portfolio to market and reflect that in its published financial statements. Why does the Federal Reserve lag behind the Swiss in disclosure and financial transparency?

Glass-Steagall never saved our financial system, so why revive it?

Published in The Hill.

The Banking Act of 1933 was passed in an environment of crisis. In March of that year, all of the nation’s financial institutions were closed in the so-called “bank holiday,” which followed widespread bank runs over the prior months.

Sen. Carter Glass, D-Va., a chief author of the bill and senior member of the Committee on Banking and Currency, was determined not to “let a good crisis go to waste.” Though he did not like the proposals from Chairman Henry Steagall, D-Ala., for federal deposit insurance, he agreed to support it on the condition that the legislation include Glass’ own pet idea that commercial banking be separated from much of the securities business.

It was poor policy from the start, but it took more than six decades to get rid of it. Now some political voices want to revive it. Financial ideas — like financial markets — have a cycle. Reviving Glass-Steagall would be an action with substantial costs, but no benefits. Its primary appeal seems to be as a political slogan.

Not having Glass-Steagall had nothing to do with the housing bubble or the resulting financial crisis of 2007 to 2009, except that being able to sell failing investment banks to big commercial banks was a major advantage for the regulators. And not having the law, in fact, had nothing to do with the crises of Glass’ own time, including the banking panic of 1932 to 1933 and the Great Depression.

Meanwhile, having Glass-Steagall in force did not prevent the huge, multiple financial busts of 1982 to 1992, which caused more than 2,800 U.S. financial institution failures, or the series of international financial crises of the 1990s.

While Glass-Steagall was in place, it required commercial banks to act, under Federal Reserve direction, as “the Fed’s assistant lenders of last resort,” whenever the Fed wanted to support floundering securities firms. This happened in the 1970 collapse of the commercial paper market, which followed the bankruptcy of the giant Penn Central Railroad, and in the “Black Monday” collapse of the stock market in 1987.

The fundamental problem of banking is always, in the memorable phrase of great banking theorist Walter Bagehot, “smallness of capital.” Or, to put the same concept in other words, the problem is “bigness of leverage.” So-called “traditional” commercial banking is, in fact, a very risky business, because making loans on a highly leveraged basis is very risky, especially real estate loans. All of financial history is witness to this.

Moreover, making investments in securities — that is, buying securities, as opposed to being in the securities business — has always been a part of traditional commercial banking. Indeed, it needs to be, for a highly leveraged balance sheet with all loans and no securities would be extremely risky and entirely unacceptable to any prudent banker or regulator.

You can make bad loans and you can buy bad investments, as many subprime mortgage-backed securities turned out to be. As a traditional commercial bank, you could make bad investments in the preferred stock of Fannie Mae and Freddie Mac, which created large losses for numerous banks and sank some of them.

Our neighbors to the north in Canada have a banking system that is generally viewed as one of the most stable, if not the most stable, in the world. The Canadian banking system certainly has a far better historical record than does that of the United States.

There is no Glass-Steagall in Canada: all the large Canadian banks combine commercial banking and investment banking, as well as other financial businesses, and the Canadian banking system has done very well. Canada thus represents a great counterexample for Glass-Steagall enthusiasts to ponder.

In Canada, there is now a serious question of a housing bubble. If this does give the Canadian banks problems, it will be entirely because of their “traditional” banking business of making mortgage loans — the vast majority of mortgages in Canada are kept on banks’ own balance sheets. If the bubble bursts, they will be glad of the diversification provided by their investment banking operations.

To really make banks safer, far more pertinent than reinstating Glass-Steagall, would be to limit real estate lending. Real estate credit flowing into real estate speculation is the biggest cause of most banking disasters and financial crises. Those longing to bring back their grandfather’s Glass-Steagall should contemplate instead the original National Banking Act, which prohibited real estate loans altogether for “traditional” banking.

Among his other ideas, Glass was a strong proponent of the “real bills” doctrine, which held that commercial banks should focus on short-term, self-liquidating loans to finance commercial trade. His views were reflected in the Federal Reserve Act, which, as Allan Meltzer has described it, had “injunctions against the use of credit for speculation” and an “emphasis on discounting real bills.” This approach which does not leave a lot of room for real estate lending.

If today’s lawmakers want to be true to Sen. Glass, they could more strictly limit the risks real estate loans create, especially in a boom, and logically call that “a 21st century Glass-Steagall.”

Even without Durbin Amendment repeal, Congress should pass the CHOICE Act

Published by the R Street Institute with Clark Packard.

House Financial Services Committee Chairman Jeb Hensarling, R-Texas, has done the yeoman’s work of putting together a host of fundamantal conservative reforms in the CHOICE Act. Although repeal of the Durbin amendment would have been a positive, pro-market reform, Congress should pass the bill even if this repeal is not included.

The most important provision of the bill allows banks the very sensible choice of maintaining substantial equity capital in exchange for a reduction in onerous and intrusive regulation. This provision puts before banks a reasonable and fundamental trade-off: more capital, less intrusive regulation. This is reason enough to support the CHOICE Act. Its numerous other reforms also include improved constitutional governance of administrative agencies, which are also a key reason to support the bill.

Accountability of banks

The 10 percent tangible leverage capital ratio, conservatively calculated, as proposed in the CHOICE Act, is a fair and workable level.

A key lesson of the housing bubble was that mortgage loans made with 0 percent skin in the game are much more likely to cause trouble. To be fully accountable for the credit risk of its loans, a bank can keep them on its own balance sheet. This is 100 percent skin in the game. The CHOICE Act rightly gives relief to banks holding mortgage loans in portfolio from regulations that try to address problems of a zero skin in the game model – problems irrelevant to the incentives of the portfolio lender.

Accountability of regulatory agencies

The CHOICE Act is Congress asserting itself to clarify that regulatory agencies are derivative bodies accountable to the legislative branch. They cannot be sovereign fiefdoms, not even the dictatorship of the Consumer Financial Protection Bureau. The most classic and still most important power of the legislature is the power of the purse. The CHOICE Act accordingly puts all the financial regulatory agencies under the democratic discipline of congressional appropriations. This notably would end the anti-constitutional direct grab from public funds that was granted to the CFPB precisely to evade the democratic power of the purse.

The CHOICE Act also requires of all financial regulatory agencies the core discipline of cost-benefit analysis. Overall, this represents very significant progress in the governance of the administrative state and brings it under better constitutional control.

Accountability of the Federal Reserve

The CHOICE Act includes the text of The Fed Oversight Reform and Modernization Act, which improves governance of the Federal Reserve by Congress. As a former president of the New York Federal Reserve Bank once testified to the House Committee on Banking and Currency: “Obviously, the Congress which set us up has the authority and should review our actions at any time they want to, and in any way they want to.” That is entirely correct. Under the CHOICE Act, such reviews would happen at least quarterly. These reviews should include having the Fed quantify and discuss the effects of its monetary policies on savings and savers.

Reform for community banks

A good summary of the results of the Dodd-Frank Act is supplied by the Independent Community Bankers of America’s “Community Bank Agenda for Economic Growth.” “Community banks,” it states, “need relief from suffocating regulatory mandates. The exponential growth of these mandates affects nearly every aspect of community banking. The very nature of the industry is shifting away from community investment and community building to paperwork, compliance and examination,” and “the new Congress has a unique opportunity to simplify, streamline and restructure.”

So it does. The House of Representatives should pass the CHOICE Act.

Detroit and Puerto Rico: Which is the worse insolvency?

Published in Real Clear Markets.

Over four decades beginning in the 1970s, the U.S. financial system had one big municipal debt crisis per decade. These were New York City in the 1970s, the Washington Public Power Supply System (“Whoops!”) in the 1980s, Orange County, California in the 1990s, and Jefferson County, Alabama in the 2000s.

But our current decade, not yet over, has already set two consecutive all-time records for the largest municipal insolvencies in history: first the City of Detroit, which entered bankruptcy in 2013, and then Puerto Rico, which is now in an equivalent of bankruptcy especially created for it by Congress (under Title III of the PROMESA Act of 2016).

Between bonds, unfunded pensions, and other claims, Detroit’s record-setting debt upon bankruptcy was $18.8 billion. Puerto Rico has far surpassed that. Its comparable debt is $122 billion, or 6.5 times that of Detroit, with $74 billion in bonds and $48 billion in unfunded pensions.

On the other hand, Puerto Rico is five times bigger than Detroit, with a population of 3.4 million, compared to 687,000. We need to look at the problems on a per capita basis.

The result is not optimistic for the creditors of Puerto Rico. As shown below, Puerto Rico’s debt per capita is much bigger—33% higher– than Detroit’s was in 2013: about $35,800 versus $26,900.

Total debt Population Debt per capita

Puerto Rico $122 billion 3,411,000 $35,800

Detroit $ 18.8 billion 687,000 $27,400

On top of more debt, Puerto Rico has much less income per capita—23% less—than Detroit did. So as it arrives in court for a reorganization of its debts, its ratio of debt per capita to income per capita is 3.1 times, compared to 1.8 times for Detroit. As shown below, this is 70% greater relative debt—or alternately stated, Puerto Rico’s per capita income to debt ratio is only 59% of Detroit’s.

Puerto Rico Detroit PR/ Detroit Detroit/ PR

Total debt per capita $35,800 $27,400 131% 77%

Income per capita $11,400 $14,900 77% 131%

Per capita debt / income 3.14x 1.84x 170% 59%

Puerto Rico’s unemployment rate is very high at over 12%. This not as huge as Detroit’s 22%, but Puerto Rico’s abysmal labor participation rate of 40%, compared to Detroit’s already low 53%, offsets this difference. This leaves Puerto Rico with proportionally even fewer earners with lower incomes to pay the taxes to pay the much higher debt.

On a macro basis, then, it appears that the creditors of Puerto Rico can expect to do even more poorly than those of Detroit. How poorly was that?

At its exit from a year and a half of bankruptcy, Detroit’s total debt had been reduced to $10.1 billion. Overall, this was 53 cents on the dollar, or a loss of 47% from face value, on average. However, various classes of creditors came out very differently. Owners of revenue bonds on self-supporting essential services came out whole on their $6.4 billion in debt. If we exclude this $6.4 billion, leaving $12.4 billion in claims by everybody else, the others all together got $3.7 billion, or a recovery of 30 cents on the dollar, or a loss of 70%, on average.

Recoveries in this group ranged from 82 cents on the dollar for public employee pensions, to 74 cents for the most senior general obligation bonds, to 44 cents on more junior bonds, to 25 cents for settling swap liabilities, to 13 cents on certificates of participation, to 10 cents on non-pension post-retirement benefits and other liabilities. It is noteworthy that the public employee pensions did take a meaningful haircut, although they came out far better than most others. The pension settlement also included special funds contributed by the State of Michigan and special funds contributed by charitable foundations to protect the art collection of the Detroit Institute of Arts. These latter factors will not be present in the Puerto Rico settlement.

As a macro estimate, if we take as a baseline Detroit’s average settlement of 53 cents on the dollar and multiply it by Puerto Rico’s 59% of Detroit’s ratio of per capita income to debt, we get a guess of 31 cents on average for all the creditors. This is not extremely different from the official fiscal plan approved by the Puerto Rico Oversight Board, which estimates cash available for debt service of about 24% of the contractual debt service over the next ten years.

What will happen in the debt reorganization bargains, what role pension debt will play, how various classes of creditors will fare with respect to each other, what political actions there may be—all is up in the air as the court begins its work.

The lenders and borrowers responsible for the huge financial mistakes which led to deep insolvency need to seriously think through, as in every debt disaster, “How did we get ourselves into this mess?!” They are a long way from getting out of it.

The Fed must be held accountable and the CHOICE Act will make it so

Published in The Hill.

This week, the House Financial Services Committee passed Chairman Jeb Hensarling’s Financial CHOICE Act. Most of the public discussion of this bill is about its changes in banking regulations, but from a constitutional point of view, even more important are the sections that deal with the accountability of regulatory agencies and the governance of the administrative state.

Accountability is a central concept in every part of the government. To whom are regulatory agencies accountable? Who is or should be their boss? To whom is the Federal Reserve, a special kind of agency, accountable? Who is or should be its boss? To whom should the Consumer Financial Protection Bureau (CFPB) be accountable? Who should be its boss?

The correct answer to these questions, and the answer given by the CHOICE Act, is the Congress. Upon reflection, we should all agree on that. All these agencies of government, populated by unelected employees with their own ideologies, agendas, and will to power — as vividly demonstrated by the CFPB — must be accountable to the elected representatives of the people, who created them, can dissolve them, and have to govern them in the meantime. All have to be part of the separation of powers and the system of checks and balances that is at the heart of our constitutional order.

But accountability does not happen automatically: Congress has to assert itself to carry out its own duty for governance of the many agencies it has created and its obligation to ensure that checks and balances actually operate.

The theme of the Dodd-Frank Act was the opposite: to expand and set loose regulatory bureaucracy in every way its drafters could think of. It should be called the Faith in Bureaucracy Act.

In the CHOICE Act, Congress is asserting itself at last to clarify that regulatory agencies are derivative bodies accountable to the Congress, that they cannot be sovereign fiefdoms — not even the Dictatorship of the CFPB, and not even the money-printing activities of the Federal Reserve.

The most classic and still most important power of the legislature is the power of the purse. The CHOICE Act accordingly puts all the regulatory agencies, including the regulatory part of the Federal Reserve, under the democratic discipline of Congressional appropriations.

This notably would end the anti-constitutional direct grab from public funds which was originally granted to the CFPB — which was designed precisely to evade the democratic power of the purse. It is sometimes objected that appropriations “inject politics” into these decisions. Well, of course! Democracy is political. Expansions of regulatory power are political, all pretense of technocracy notwithstanding.

The CHOICE Act also requires of all financial regulatory agencies the core discipline of cost-benefit analysis. It provides that actions whose costs exceed their benefits should not be undertaken without special justification. That’s pretty logical and hard to argue with. Naturally, assessing the future costs and benefits of any action is subject to uncertainties — perhaps very large uncertainties. But this is no reason to avoid the analysis — indeed, forthrightly confronting the uncertainties is essential.

The CHOICE Act also requires an analysis after five years of how regulations actually turned out in terms of costs and benefits. This would reasonably lead — we should all hope it will — to scrapping the ones that didn’t work.

Further Congressional governance of regulatory agencies is provided by the requirement that Congress approve major regulatory rules — those having an economic effect of $100 million or more. Congress would further have the authority to disapprove minor rules if it chooses by joint resolution. This is a very effective way of reminding everybody involved, including the Congress itself, who actually is the boss and who has the final responsibility.

On the Federal Reserve in particular, the CHOICE Act devotes a title to “Fed Oversight Reform and Modernization,” which includes improving its accountability.

“Obviously, the Congress which set us up has the authority and should review our actions at any time they want to, and in any way they want to,” once succinctly testified a president of the New York Fed. Under the CHOICE Act, such reviews would happen at least quarterly.

In these reviews, I recommend that the Federal Reserve should in addition be required to produce a Savers Impact Statement, quantifying and discussing the effects of its monetary policies on savings and savers.

The CHOICE Act requires of new regulatory rules that they provide “an assessment of how the burden imposed … will be distributed among market participants.” This good idea should by analogy be applied to burdens imposed on savers by monetary actions.

By my estimate, the Federal Reserve has taken since 2008 over $2 trillion from savers and given it to borrowers. The Federal Reserve may want to defend its sacrifice of the savers as a necessary evil — but it ought to openly and clearly quantify the effects and discuss the economic and social implications with the Congress.

In sum, the CHOICE Act represents major improvements in the accountability of government agencies to the Congress and ultimately to the people. These are very significant steps forward in the governance of the administrative state to bring it under better constitutional control.

Puerto Rico’s inevitable debt restructuring arrives

Published by the R Street Institute.

“Debt that cannot be repaid will not be repaid” is Pollock’s Law of Finance. It applies in spades to the debt of the government of Puerto Rico, which is dead broke.

Puerto Rico is the biggest municipal market insolvency and, now, court-supervised debt restructuring in history. Its bond debt, in a complex mix of multiple governmental issuers, totals $74 billion. On top of this, there are $48 billion in unfunded public-pension liabilities, for a grand total of $122 billion. This is more than six times the $18.5 billion with which the City of Detroit, the former municipal insolvency record holder, entered bankruptcy.

The Commonwealth of Puerto Rico will not enter technical bankruptcy under the general bankruptcy code, which does not apply to Puerto Rico. But today, sponsored by the congressionally created Financial Oversight and Management Board of Puerto Rico, it petitioned the federal court to enter a similar debtor protection and debt-settlement proceeding. This framework was especially designed by Congress for Puerto Rico under Title III of the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) of 2016. It was modeled largely on Chapter 9 municipal bankruptcy and will operate in similar fashion.

This moment was inevitable, and Congress was right to provide for it. It is a necessary part of the recovery of Puerto Rico from its hopeless financial situation, fiscal crisis and economic malaise. But it will make neither the creditors, nor the debtor government, nor the citizens of Puerto Rico happy, for all have now reached the hard part of an insolvency: sharing out the losses. Who gets which losses and how much the various interested parties lose is what the forthcoming proceeding is all about.

The proceedings will be contentious, as is natural when people are losing money or payments or public services, and the Oversight Board will get criticized from all sides. But it is responsibly carrying out its duty in a situation that is difficult, to say the least.

There are three major problems to resolve to end the Puerto Rican financial and economic crisis:

First, reorganization of the government of Puerto Rico’s massive debt: this began today and will take some time. In Detroit, the bankruptcy lasted about a year and a half.

Second, major reforms of the Puerto Rican government’s fiscal and financial management, systems and controls. Overseeing the development and implementation of these is a key responsibility of the Oversight Board.

Third—and by far the most difficult step and the most subject to uncertainty—is that Puerto Rico needs to move from a failed dependency economy to a successful market economy. Economic progress from internally generated enterprise, employment and growth is the necessary long-term requirement. Here there are a lot of historical and political obstacles to be overcome. Not least, as some of us think, is that Puerto Rico is trapped in the dollar zone so it cannot have external adjustment by devaluing its currency.

The first and second problems can be settled in a relatively short time; the big long-term challenge, needing the most thought, is the third problem.

The story of the Puerto Rican financial and economic crisis just entered a new chapter, but it is a long way from over.

CHOICE Act would be major progress for financial system

Published by the R Street Institute.

Mr. Chairman, Ranking Member Waters and members of the committee, thank you for the opportunity to be here today. I am Alex Pollock, a senior fellow at the R Street Institute, and these are my personal views. I have spent more than four decades working in and on banking and housing finance, including 12 years as president and CEO of the Federal Home Loan Bank of Chicago and 11 years focused on financial policy issues at the American Enterprise Institute, before joining R Street last year. I have experienced and studied many financial crises and their political aftermaths, starting when the Federal Reserve caused the Credit Crunch of 1969 when I was a bank trainee.

My discussion will focus on three key areas of the proposed CHOICE Act. All deal with essential issues and, in all three, the CHOICE Act would create major progress for the financial system, for constitutional government and for financing economic growth. These areas are accountability, capital and congressional governance of the administrative state.

The CHOICE Act is long and complex, but there are a very large number of things to fix—like the Volcker Rule, among many others– in the even longer Dodd-Frank Act.

A good summary of the real-world results of Dodd-Frank is supplied by the “Community Bank Agenda for Economic Growth” of the Independent Community Bankers of America. “Community banks,” it states, “need relief from suffocating regulatory mandates. The exponential growth of these mandates affects nearly every aspect of community banking. The very nature of the industry is shifting away from community investment and community building to paperwork, compliance and examination.” I think this observation is fair.

The Community Bankers continue: “The new Congress has a unique opportunity to simplify, streamline and restructure.” So it does, and I am glad this committee is seizing the opportunity.

In November 2016, Alan Greenspan remarked, “Dodd-Frank has been a—I wanted to say ‘catastrophe,’ but I’m looking for a stronger word.” Although the financial crisis and the accompanying recession had been over for a year when Dodd-Frank was enacted, in the wake of the crisis, as always, there was pressure to “do something” and the tendency to overreact was strong. Dodd-Frank’s something-to-do was to expand regulatory bureaucracy in every way its drafters could think of—it should be known as the Faith in Bureaucracy Act. This was in spite of the remarkably poor record of the government agencies, since they were important causes of, let alone having failed to avoid, the housing bubble and the bust. Naïve faith that government bureaucracies have superior knowledge of the financial future is a faith I do not share.

Accountability of the Administrative State

Accountability is a, perhaps the, central concept in every part of the government. To whom are regulatory agencies accountable? Who is or should be their boss? To whom is the Federal Reserve, a special kind of agency, accountable? Who is or should be its boss? To whom should the Consumer Financial Protection Bureau be accountable? Who should be its boss?

The answer to all these questions is of course: the Congress. We should all agree on that. All these agencies of government, populated by unelected employees, must be accountable to the elected representatives of the people, who created them, can dissolve them and have to govern them in the meantime. All have to be part of the separation of powers and the system of checks and balances which is at the heart of our constitutional order. This also applies to the Federal Reserve. In spite of its endlessly repeated slogan that it must be “independent,” the Federal Reserve must equally be accountable.

But accountability does not happen automatically: Congress has to assert itself to carry out its own duty for governance of the many agencies it has created and for its obligation to ensure that checks and balances actually operate.

The CHOICE Act is an excellent example of the Congress asserting itself at last to clarify that regulatory agencies are derivative bodies accountable to the Congress, that they cannot be sovereign fiefdoms—not even the dictatorship of the CFPB, and not even the money-printing activities of the Federal Reserve.

The most classic and still most important power of the legislature is the power of the purse. The CHOICE Act accordingly puts all the regulatory agencies, including the regulatory part of the Federal Reserve, under the democratic discipline of congressional appropriations. This notably would end the anti-constitutional direct grab from public funds which was originally granted to the CFPB—and which was designed precisely to evade the democratic power of the purse. It is sometimes objected that appropriations “inject politics” into these decisions. Well, of course! Democracy is political. Regulatory expansions are political, all pretense of technocracy notwithstanding.

The CHOICE Act also requires of all financial regulatory agencies the core discipline of cost-benefit analysis. It provides that actions whose costs exceed their benefits should not be undertaken without special justification. That’s pretty logical and hard to argue with. Naturally, assessing the future costs and benefits of any action is subject to uncertainties—perhaps very large uncertainties. But this is no reason not to do the analysis—indeed, forthrightly to confront the uncertainties is essential.

The CHOICE Act also requires an analysis after five years of how regulations actually turned out in terms of costs and benefits. This would reasonably lead—I hope it will—to scrapping the ones that didn’t work.

To enhance and provide an overview of the regulatory agencies’ cost-benefit analyses, the CHOICE Act requires the formation of a Chief Economists Council, comprising the chief economist of each agency. This appeals to me, because it might help the views of the economists, who tend to care a lot about benefits versus costs, balance those of their lawyer colleagues, who may not.

Further congressional governance of regulatory agencies is provided by the requirement that Congress approve major regulatory rules—those having an economic effect of $100 million or more. Congress would further have the authority to disapprove minor rules if it chooses by joint resolution. This strikes me as a very effective way of reminding everybody involved, including the Congress itself, who actually is the boss and who has the final responsibility.

Taken together, these provisions are major increases in the accountability of regulatory agencies to the Congress and ultimately to the people. They are very significant steps forward in the governance of the administrative state and bringing it under better constitutional control.

Accountability of the Federal Reserve

A word more on the Federal Reserve in particular, since the CHOICE Act devotes a title to “Fed Oversight Reform and Modernization” (FORM), which includes improving its governance by Congress. In a 1964 report, “The Federal Reserve after Fifty Years,” the Domestic Finance Subcommittee of the ancestor of this committee, then called the House Committee on Banking and Currency, disapprovingly reviewed the idea that the Federal Reserve should be “independent.” This was in a House and committee controlled by the Democratic Party. The report has this to say:

“An independent central bank is essentially undemocratic.”

“Americans have been against ideas and institutions which smack of government by philosopher kings.”

“To the extent that the [Federal Reserve] Board operates autonomously, it would seem to run counter to another principle of our constitutional order—that of the accountability of power.”

In my view, all these points are correct.

The president of the New York Federal Reserve Bank testified to the 1964 committee: “Obviously, the Congress which set us up has the authority and should review our actions at any time they want to, and in any way they want to.” That is entirely correct, too.

Under the CHOICE Act, such reviews would happen at least quarterly. I would like to suggest an additional requirement for these reviews. I believe that the Federal Reserve should be required to produce a Savers Impact Statement, quantifying and discussing the effects of its monetary policies on savings and savers.

The CHOICE Act requires of new regulatory rules that they provide “an assessment of how the burden imposed…will be distributed among market participants.” This good idea should by analogy be applied to burdens imposed on savers by monetary actions. By my estimate, the Federal Reserve has taken since 2008 more than $2 trillion from savers and given it to borrowers. The Federal Reserve may defend its sacrifice of the savers as a necessary evil—but it ought to openly and clearly quantify the effects and discuss the economic and social implications with the Congress.

Accountability of Banks

Let me turn to accountability in banking, under two themes: providing sufficient equity to capitalize your own risks; and bearing the risk you create—otherwise known as “skin in the game.”

The best-known provision of the CHOICE Act is to allow banks the very sensible choice of having substantial equity capital—to be specific, a 10 percent or more tangible leverage capital ratio—in exchange for reduction in onerous and intrusive regulation. Such regulation becomes less and less justifiable as the capital rises. As I testified last July, this is a rational and fundamental trade-off: More capital, less intrusive regulation. Want to run with less capital and thus push more of your risk onto the government? You get more regulation.

It is impossible to argue against the principle that there is some level of equity capital at which this trade-off makes sense for everybody—some level of capital at which everyone, even habitual lovers of bureaucracy, would agree that the Dodd-Frank burdens are superfluous, with costs higher than their benefits.

But exactly what that level is, can be and is, disputed. Because banking markets are so shot through with government guarantees and distortions, there is no clear market test. All answers are to some degree theoretical, and the estimates vary—some think the number is less than 10 percent leverage capital—for example, economist William Cline finds that optimal bank leverage capital is 7 percent—or 8 percent to be conservative. Some think it is more—15 percent has been suggested more than once. The International Monetary Fund came up with a desired risk-based capital range which they concluded was “consistent with 9.5 percent” leverage capital—that’s pretty close to 10 percent. Distinguished banking scholar Charles Calomiris suggested “roughly 10 percent.” My opinion is that the fact that no one knows the exactly right answer should not stop us from moving in the right direction.

All in all, it seems to me that the 10 percent tangible leverage capital ratio, conservatively calculated, as proposed in the CHOICE Act is a fair and workable level to attain “qualifying banking organization” status, in other words, the more capital-less onerous regulation trade-off. The ratio must be maintained over time, with a one-year remediation period if a bank falls short, and with immediate termination of the qualifying status if its leverage capital ratio ever falls below 6 percent—a ratio sometimes considered very good. All this seems quite reasonable to me.

The CHOICE Act mandates a study of the possible regulatory use of the “non-performing asset coverage ratio,” which is similar to the “Texas ratio” from the 1980s. The point is to compare the level of delinquent and nonaccrual assets to the available loan loss reserves and capital, as a way of estimating how real the book equity is. This study is a good idea.

To be fully accountable for the credit risk of your loans, you can keep them on your own balance sheet. This is 100 percent skin in the game. One of the true (not new, but true) lessons of the housing bubble was that loans made with 0 percent skin in the game are much more likely to cause trouble. So Dodd-Frank made up a bunch of rules to control the origination of mortgages which feed into a zero skin in the game system. These rules are irrelevant to banks that keep their own loans.

The CHOICE Act therefore gives relief to banks holding mortgage loans in portfolio from regulations which arose from problems of subprime securitization, problems alien to the risk structure and incentives of the portfolio lender.

Accountability for Deals with Foreign Regulators

A challenging issue in the governance of the administrative state are deals that the Treasury and the Federal Reserve are alleged to have made with foreign regulators and central bankers, is in the context of their participation in the international Financial Stability Board (FSB). These deals have been made, the suggestion is, outside of the American legal process, and then imported to the United States.

Were there any such deals, or were there merely discussions?

We know that the FSB has publicly stated that it will review countries for “the implementation and effectiveness of regulatory, supervisory or other financial sector standard and policies as agreed by the FSB.” As agreed by the FSB? Does that mean a country, specifically the United States, is supposed to be bound by deals made in this committee? Did the American participants in these meetings feel personally committed to implement some agreements?

We also know that there is a letter that would shine light on this question: a September 2014 letter from Mark Carney, the governor of the Bank of England and chairman of the FSB, to then-Treasury Secretary Lew. This letter allegedly reveals the international discussions about American companies, including it is said, whether Berkshire Hathaway should be designated a systemically important insurer (an idea not politically popular with the Obama administration). A Freedom of Information Act request for the letter has previously been denied by the Treasury, which admits, however, that it exists.

I believe that Congress should immediately request a copy of this letter as part of its consideration of the “International Processes” subtitle of the CHOICE Act. While at it, Congress should request any other correspondence regarding possible agreements within the FSB.

The international subtitle rightly requires regulatory agencies and the Treasury to tell the Congress what subjects they are addressing in such meetings and whether any agreements have been made.

Accountability for Emerging Financial System Risks

The CHOICE Act makes a number of positive changes to the structure and functions of the Financial Stability Oversight Council (FSOC). Here I would like to suggest a possible addition.